How to Legally Trade Crypto in Vietnam: A 2025 Step-by-Step Guide

July 17, 2025

How to Legally Use Crypto in Vietnam Under the 2025 Law

Vietnam’s 2025 legalization of crypto is more than a policy update — it’s a structural shift in how digital assets are recognized, taxed, and transacted. Crypto is no longer seen as a gray-area hobby or speculative loophole. With the passing of the Vietnam crypto law and the introduction of Virtual Digital Asset (VDA) rules, everyday users, businesses, and tech innovators are now part of a formal financial ecosystem. This guide walks you through how to operate legally and confidently within this new framework.

Step 1: Understand What Counts as a Virtual Digital Asset in in Vietnam Crypto Law 2025

Credit from Lexology

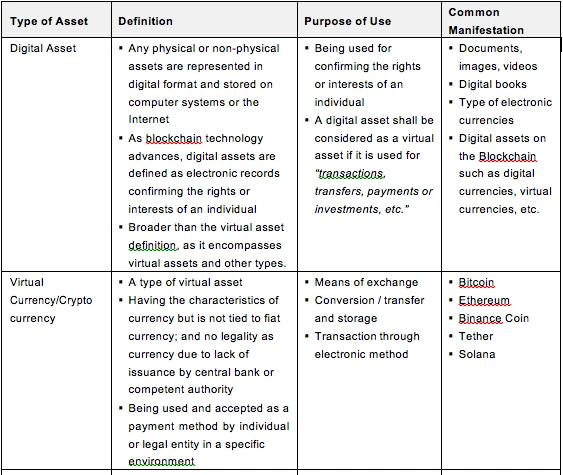

The first step is understanding the government’s definition of a Virtual Digital Asset. In Vietnam, VDAs now include a wide range of blockchain-based assets such as cryptocurrencies, utility tokens, investment tokens, NFTs, and tokenized securities. The classification depends on the asset’s function. For instance, tokens used for payment purposes face lighter oversight compared to those used for raising capital or delivering dividends, which must undergo stricter review. This classification system determines how each asset is taxed, regulated, or licensed, and it’s crucial for users and developers to know how their assets are labeled.

Step 2: Use a Licensed Exchange

Credit from Vietnam Investment Review – VIR

If you want to buy or sell crypto, you’ll need to do so through an officially licensed exchange. The Ministry of Finance has created a public registry of platforms that comply with national VDA rules. These exchanges are required to follow identity verification (KYC), anti-money laundering (AML), and financial reporting protocols. This doesn’t just protect users from scams — it also enables the government to trace taxable activity and provide a safer trading environment. Unlicensed or offshore exchanges may be accessible but using them could result in legal complications, frozen assets, or tax disputes.

Step 3: Register a Compliant Crypto Wallet

While individuals are free to open and use crypto wallets, the 2025 law states that any wallet used in transactions involving licensed platforms must meet compliance checks. That means your wallet provider must support user identity verification and offer clear traceability. Although self-custody wallets are not banned, users must understand that untraceable wallet activity linked to large transactions could trigger regulatory flags. It’s safest to link your wallet with a licensed exchange to ensure both usability and protection.

Step 4: Report Your Crypto Income and Holdings

Credit from ACCESS Newswire

Perhaps the most important legal responsibility now placed on Vietnamese users is tax reporting. Crypto is now officially treated as a financial asset and is subject to personal income tax or corporate tax depending on who holds it. Income from trading, staking, mining, airdrops, or even NFT sales must be declared. You’ll need to calculate market value at the time of receipt and report gains or losses in your annual filings. The General Department of Taxation is also working with local exchanges to enable automatic reporting. Keeping clean records is no longer just smart — it’s legally required.

Step 5: Launching a Crypto Project? You’ll Need a License

For businesses and developers hoping to launch a token, run a DeFi platform, or start a blockchain-based marketplace, licensing is mandatory. Vietnam now requires VDA service providers to submit detailed applications, including whitepapers, tokenomics models, and risk disclosures. These projects are evaluated for financial stability, cybersecurity standards, and user protection practices. Without this license, you cannot advertise, sell, or distribute investment-related digital assets to the public. Getting licensed isn’t a mere formality — it’s the difference between legal innovation and regulatory violation.

Step 6: Know What You Can and Cannot Do in Vietnam Crypto Law 2025

While the law opens many doors, it also draws some firm boundaries. You are now allowed to trade crypto, send it between wallets, participate in staking, or even get paid in tokens — provided those actions follow reporting and compliance rules. But not everything is permitted. Crypto still isn’t legal tender in Vietnam, meaning businesses are not obligated to accept it. Also, if you use unregistered exchanges, participate in unauthorized ICOs, or avoid tax reporting, you may face fines, wallet blacklisting, or even criminal investigations in serious cases.

Step 7: Stay Informed and Practice Smart Security

Compliance is not a one-time setup — it’s an ongoing process. The crypto legal environment in Vietnam is still developing. New circulars, licensing updates, and tax adjustments are being introduced regularly. That’s why users are encouraged to follow updates from the Ministry of Finance and major licensed exchanges. You should also maintain strong security practices: use multi-factor authentication, avoid suspicious platforms, and check whether new services are on the official approval list before sending any funds.

Conclusion of Vietnam Crypto Law 2025: Crypto in Vietnam Is Legal, but Not Lawless

Credit from Datawallet

Vietnam’s 2025 crypto law marks a turning point in the country’s digital finance journey. It doesn’t merely permit crypto use — it legitimizes it through structure and regulation. Whether you’re a curious student, a full-time trader, or a startup founder building the next blockchain solution, this law provides clear rails to follow.

That clarity comes with responsibility. Users must now navigate compliance checks, tax filings, and platform due diligence. But the trade-off is a safer, more predictable environment where innovation and participation can thrive. Vietnam’s crypto future is here — and now it has rules.