Using USDT in Thailand: A Practical Guide to Stablecoin Adoption in 2025

October 26, 2024

A Step-by-Step Guide to Using USDT in Thailand in 2025

Tether (USDT) has become one of the most-used digital assets in Thailand’s crypto ecosystem. Whether you’re a casual user, freelancer, or full-time trader, understanding how to use USDT in Thailand efficiently is crucial in 2025.

In this guide, we’ll walk through how to get started with USDT—from acquisition to practical use—and explain why it’s gaining so much traction in Thailand this year.

Step 1: Understand Why USDT Is So Popular in Thailand

Before diving in, it’s worth knowing why USDT is being adopted so widely in 2025:

- Stable value: Unlike Bitcoin or Ethereum, USDT is pegged to the US dollar, reducing price volatility.

- Cross-border ease: Ideal for freelancers and online sellers dealing with foreign clients.

- Low transfer costs: Especially over TRC-20 (TRON network), fees are minimal.

- Fast settlement: Transactions typically complete in minutes.

Locally, it’s also seen as a safe alternative when the baht is unstable or when users want to hold digital assets without high risk.

Credit from : Cregis

Step 2: Choose a Platform to Buy USDT

To use USDT, you first need to buy it. In Thailand, here are your most common options:

- Bitkub: A Thailand-based exchange with THB trading pairs.

- Binance P2P: A favorite for peer-to-peer trades with flexible payment options.

- Satang Pro: Another local option regulated by the Thai SEC.

When using these platforms:

- Register and complete KYC verification

- Link a Thai bank account or use bank transfer for fiat deposits

- Choose USDT as your asset and proceed with the purchase

For P2P platforms like Binance, make sure to only trade with verified users and never complete off-platform transactions.

Credit from : The Financial Express

Step 3: Pick the Right Network for Transfers

USDT runs on multiple blockchain networks, each with different fee structures and speeds. For Thai users, the TRC-20 version (on the TRON network) is the most widely used due to:

- Lower gas fees (often less than ฿1)

- Fast confirmation times

- Broad wallet support

Alternatives include:

- ERC-20 (Ethereum) – Widely accepted but more expensive

- BEP-20 (BNB Chain) – Moderate fees, supported by some Thai platforms

Always double-check the wallet address format and network before sending any funds.

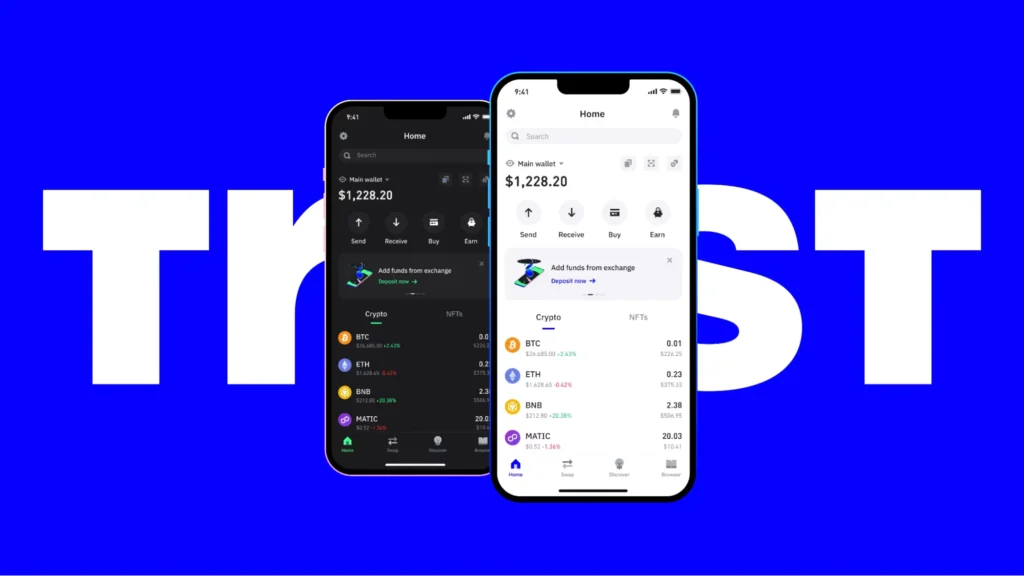

Step 4: Set Up a Secure Wallet

Once you’ve purchased USDT, store it in a secure wallet. Here are your choices:

- Exchange Wallets (Bitkub, Binance) – Easy for active trading but less secure long-term

- Hot Wallets (Trust Wallet, MetaMask) – Mobile-friendly and ideal for everyday use

- Cold Wallets (Ledger, Trezor) – Best for long-term storage and larger balances

Use two-factor authentication and backup your wallet’s seed phrase in multiple locations for added safety.

Credit from : Trust Wallet

Step 5: Start Using USDT in Real Life

In Thailand, USDT is increasingly being used for:

- Freelance payments from overseas clients

- Peer-to-peer payments among traders and friends

- Crypto savings as an alternative to fiat

- Online purchases, especially from international stores

Some small businesses in Chiang Mai and Bangkok now accept USDT directly—especially those serving tourists or digital nomads. For now, payments are still mostly informal or P2P, but momentum is building.

Step 6: Stay on the Right Side of Regulations

As of 2025, Thailand allows the legal trading and holding of USDT. However, it is not recognized as legal tender. Key points to remember:

- Use licensed exchanges to buy and sell

- Keep transaction records for tax reporting

- Businesses accepting crypto should check local reporting requirements

The Thai SEC continues to support innovation while monitoring the market closely. So far, P2P usage of USDT remains unrestricted, which is a key reason for its widespread growth.

Step 7: Monitor Long-Term Trends and Use Cases

Thailand’s adoption of USDT appears to be more than a short-term trend. As stablecoin use grows:

- More platforms are integrating USDT as the default token

- Younger generations are adopting stablecoins faster than banks

- Economic pressures (both global and local) are making digital dollars attractive

The takeaway? USDT is positioning itself as a practical financial tool, not just a trader’s asset.

Conclusion: USDT in Thailand Is Simple, Flexible, and Useful

In a country where crypto adoption is evolving rapidly, USDT offers something rare—consistency. For everyday users in Thailand, it’s become a way to transact, save, and earn—without the chaos of price swings or high transfer costs.

If you’re looking for a reliable entry point into crypto or a smarter way to manage your digital finances in 2025, USDT might be the place to start.