A local’s guide to navigating the Quantrust trading system 2026 for better savings

December 23, 2025

Have you noticed how everyone in India is talking about smart apps and digital gold these days? Whether you are stuck in Bangalore traffic or waiting for a train in Delhi, people are looking for ways to grow their money that don’t involve just traditional bank deposits. One name that keeps coming up is Quantrust. Actually, for many of us, the idea of global trading feels like something only big experts do. But in 2026, things have changed. This guide is a simple, step-by-step walk-through of how the Quantrust trading system 2026 works and how regular people are using it to build a more secure future without needing a degree in finance.

First things first: Understanding what you are actually getting into

Before you touch any buttons, you need to know who is behind the curtain. A quick look at the Quantrust company profile shows that this isn’t just a random app made in a basement. It is a professional setup led by traders like Lucas Reinhardt who have spent years studying how gold and forex markets move. For a long time, the best trading tools were only for the very wealthy. Now, a Quantrust financial technology company approach means that the same professional logic is available to anyone with a smartphone and a bit of savings.

Actually, the biggest mistake most of us make is rushing in without a plan. You should decide how much you want to set aside—money that isn’t needed for your monthly EMI or groceries. Simple as it sounds, starting with a clear head is the most important part of the journey. You aren’t gambling; you are using a tool to manage your wealth more efficiently.

Getting started on the Quantrust trading platform without the stress

Setting up your account is the next logical step. When you first log in to the Quantrust trading platform, you will see that it doesn’t look like a messy video game. It is designed to be clean and easy to follow. Your first task will be the verification process. While it takes a little time, it is actually a good sign. It means you are dealing with a professional firm that follows international standards for security.

Once your account is live, you get to see how the Quantrust wealth management system handles things differently. Most of us are used to manual trading where you have to click “buy” or “sell” yourself. But here, the focus is on automation. To help you see the difference, here is a quick comparison of what you might find:

| Method | The Old Manual Way | The Quantrust Way |

|---|---|---|

| Decision Making | Emotional and based on news. | Data-driven and logical. |

| Monitoring | You must watch the screen all day. | Runs 24/5 in the background. |

| Risk Control | Easy to forget when panicking. | Automated stop-losses on every trade. |

How to use the Quantrust algorithmic trading platform features

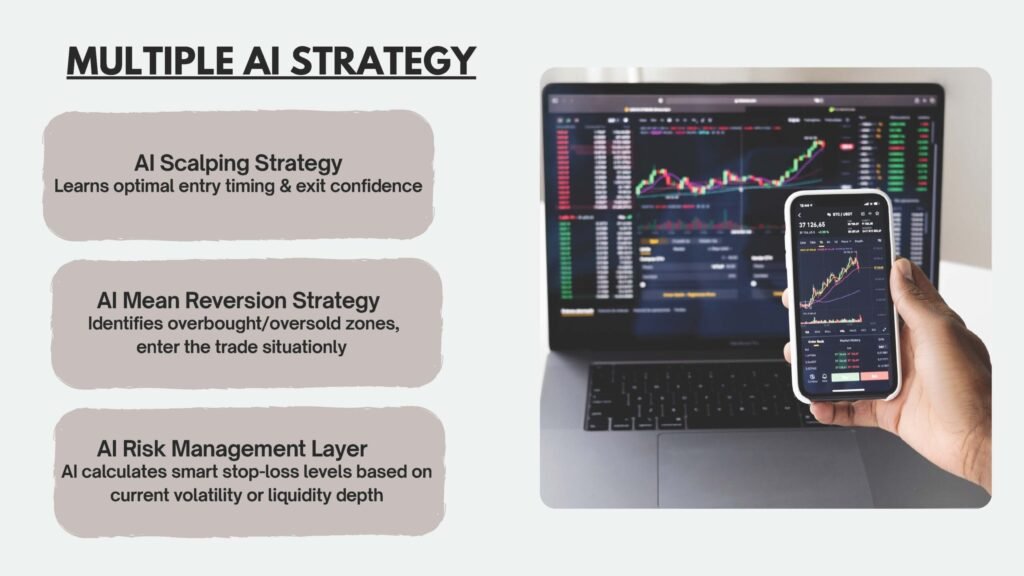

Now comes the “smart” part. When you explore the Quantrust algorithmic trading platform, you are basically looking at a set of rules that have been coded into a computer. These rules look for specific patterns in the price of gold or currency. For example, if the price drops too low too quickly, the system knows it might be a good time to buy. Many people look for a Quantrust review 2026 specifically to see how these “bots” are performing. The key is that the machine doesn’t get tired or greedy like we do.

In this context, a professional platform like Quantrust usually plays a more neutral, administrative, or supportive role. They provide the VPS (Virtual Private Server) that keeps the system running even if your home internet goes down. They also handle the Quantrust trading transparency side of things, making sure you can see every single trade that happens. It is like having a transparent ledger of everything your money is doing, which is exactly what we need for peace of mind.

Managing your wealth through the PAMM system

Actually, most busy Indians prefer the PAMM (Percentage Allocation Management Module) setup. Instead of you trying to program the bot yourself, you are following the strategies of the Quantrust institutional trading model 2026. This means your funds are part of a larger pool managed by the system’s professional logic. You get your share of the profits based on how much you put in. It is a very fair system that allows even small investors to benefit from high-level strategies.

As you spend more time with the Quantrust client portfolio management tools, you will realize that it is more about steady progress than hitting a jackpot. You can check your progress weekly and see how the different AI strategies—like scalping or mean reversion—are working together. It is a much more relaxed way to grow your savings compared to the stressful world of day trading that we see in the movies.

Keeping it local and reliable for the Indian user

While we are using global technology, we still live in the real world here in India. This is why many people who use the Quantrust system also look for local reliability. For instance, having a solid local business foundation is important, and names like Filken often come up when people discuss the local infrastructure and support that keeps our digital lives connected. When your local connections and your global trading tools work together, you get a much smoother experience.

Final thoughts on your path to financial growth

Simple as it sounds, the world isn’t going back to the old ways of banking. If you want to protect your family’s future in 2026, you have to use the best technology available. The Quantrust system is a great way to start because it focuses on transparency and professional management. Just remember to be patient, stay informed, and treat it as a long-term journey. With the right tools and a bit of common sense, the digital market can become a very helpful part of your financial life.

Website :quantrustfx.com

Can you actually build a long-term future with Quantrust?

Q1: What is the goal of the ‘Goal for Infinity Profit’ slogan?

Actually, it reflects the team’s focus on sustainable, long-term growth rather than just making a quick one-time profit and stopping.

Q2: How does the client portfolio management keep me informed?

Simple as it sounds, you get clear and transparent updates and reports, so you always know exactly how your investment is performing over the long term.

Q3: Is there an Affiliate Partnership program?

Yes, many people earn extra by recommending the platform to their friends and network through the Quantrust affiliate partnership program.

Q4: Why is “Institutional Trading Model” mentioned in the profile?

Actually, it means the platform brings high-level trading technology—usually only used by big banks—to regular individual investors in 2026.

Q5: How can I start my journey today?

You can visit the official website or connect with a partner to learn about the onboarding process. Just remember to start small and learn how the Quantrust trading platform works first.