Prorex Trading Platform Launches New Signals, Accounts, and Bonus Options

September 23, 2025

In a recent analysis of the retail trading sector, attention has turned to the tools available to individual investors. This report provides a factual overview of the Prorex trading platform, a system that has entered the competitive market for online financial services. The following is a breakdown of its core components, financial structure, and operational framework, intended to provide clarity for those monitoring the fintech landscape.

Content

An Overview of the Prorex Trading Platform’s Core Functionality

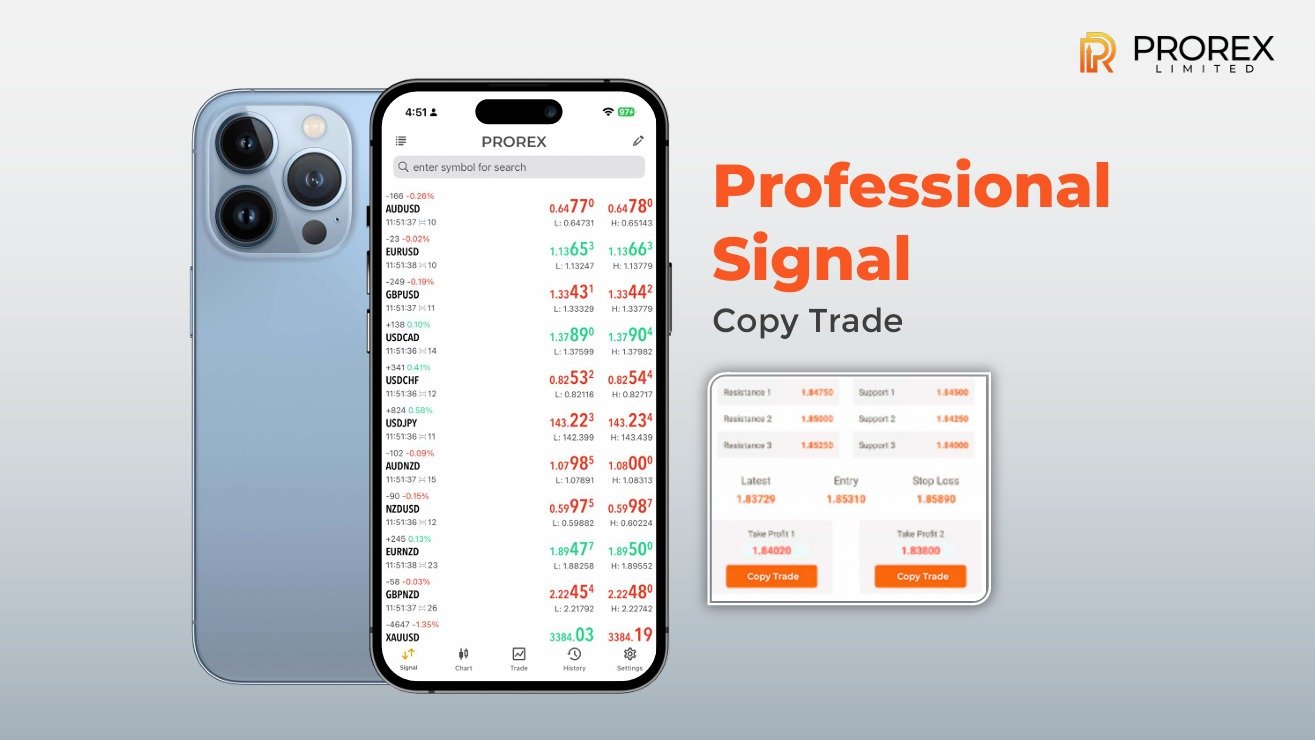

The Prorex trading platform is equipped with a suite of analytical tools designed to facilitate prorex online trading. Reports on its interface indicate a focus on a streamlined user experience, providing traders with access to real-time charting, technical indicators, and order management systems. These features are considered standard for platforms aiming to support a detailed prorex investment strategy. The primary function is to provide users with the necessary data and execution capabilities to participate in the financial markets.

Details on Account Structures and Financial Conditions

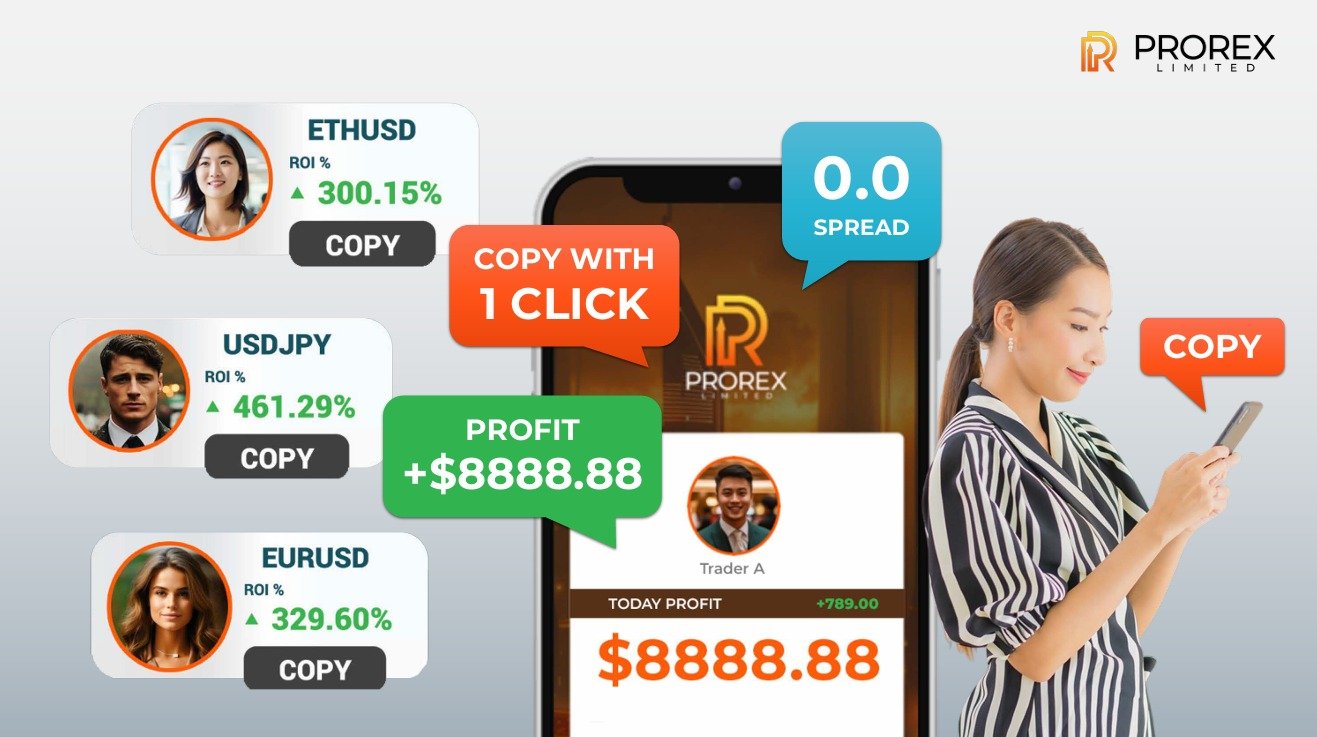

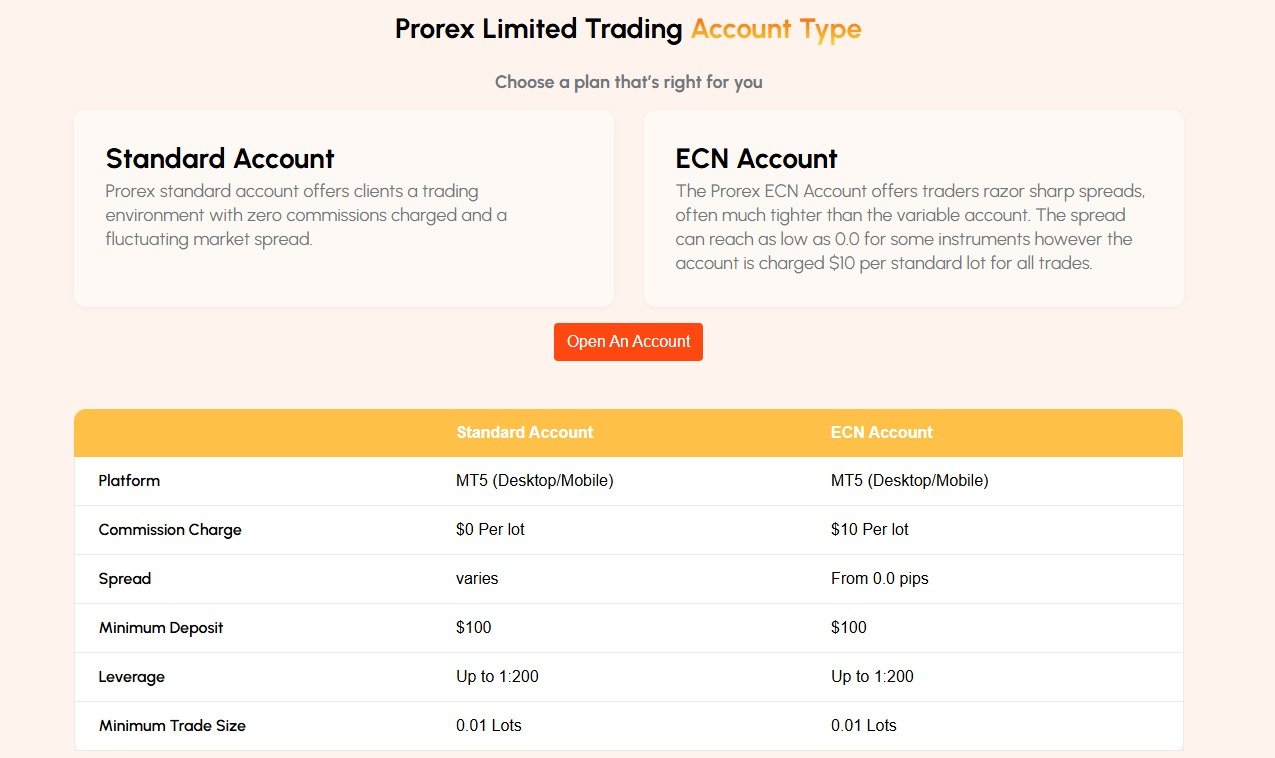

Access to the platform requires a prorex trading account. Prospective users should note the prorex minimum deposit, which establishes the entry-level capital required to begin trading. The platform operates on a variable prorex spread model, which represents a primary cost for users executing trades. From time to time, a prorex trading bonus may be offered, subject to specific terms. Additionally, the system provides prorex trading signals—also known as prorex signals—as a data feature available to those with an active prorex account for their prorex forex trading activities.

Regulatory and Compliance Status of the Prorex Trading Platform

A critical data point for any financial service provider is its regulatory standing. The operational integrity of the platform is governed by prorex regulation. Adherence to a regulatory framework is a key standard in the industry, designed to provide client protection and ensure fair operational practices. Before committing funds, potential users actively confirm the platform’s current compliance status as part of their due diligence.

Concluding Summary of Findings

In summary, the Prorex trading platform presents a comprehensive set of tools and features standard for the current retail trading market. The key data points for consideration include its functional interface, the tiered account structure with its associated financial requirements, and its stated adherence to regulatory guidelines. This information serves as a factual brief for traders and investors currently conducting their own independent market research.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia