Breaking News: Prorex Investment Expands Global Access to Forex Trading Opportunities

October 7, 2025

As the 2025 trading year continues, retail and professional traders are closely scrutinizing the brokerage landscape. The focus of today’s report is on the operational framework of the Prorex investment service, a platform gaining attention within the prorex online trading community. Our objective is to provide a direct, factual breakdown of its components, from its core technology to its regulatory standing, to inform interested parties.

Content

Operational Report: A Look at the Prorex Investment Technology

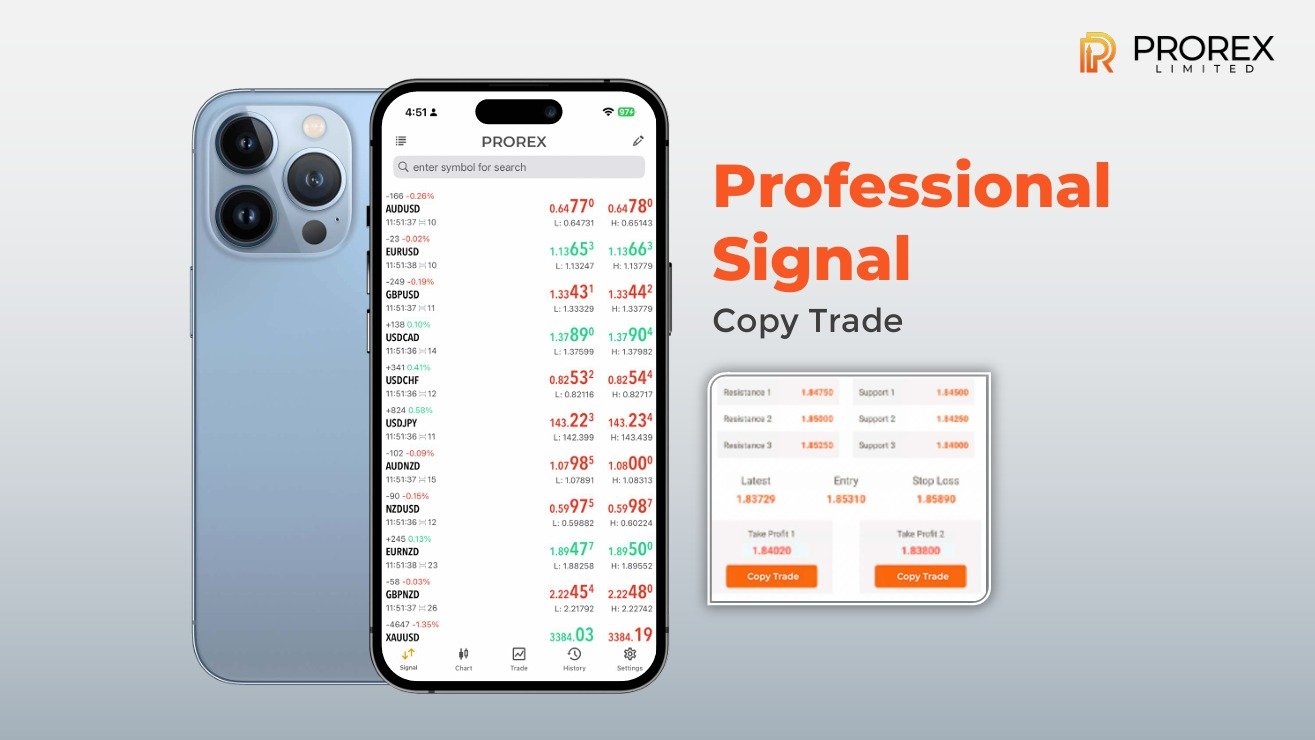

At the core of the service is the prorex trading platform, the primary interface for all market operations. This system provides users with access to key data, including prorex trading signals. These prorex signals function as analytical data points for market consideration.The accuracy of Prorex trading signals varies with changing market conditions. Traders must factor the Prorex spread into their financial projections, as it directly affects operational costs.

Financial Briefing: Analyzing the Prorex Investment Account Structure

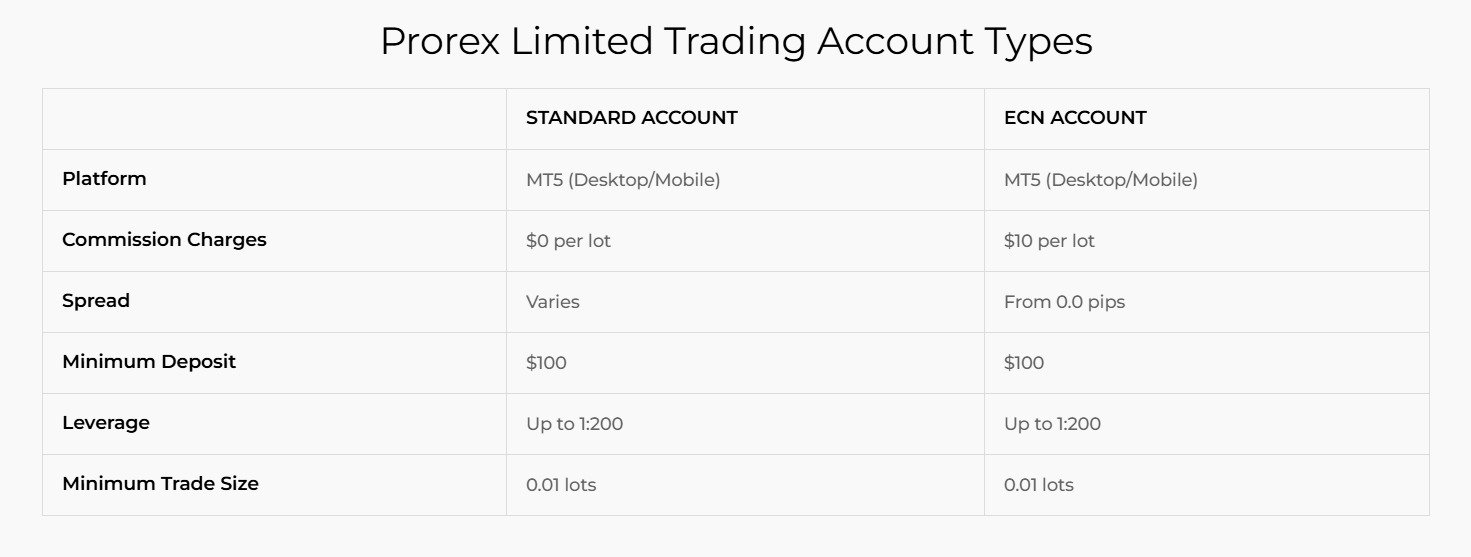

Traders access the platform directly through their Prorex account. The company offers several Prorex account types, with entry differentiated by the required prorex minimum deposit. Our analysis of how does Prorex investment work indicates a structured system for capital management. A critical performance indicator for any brokerage is the efficiency of its financial transactions. The processing times for Prorex deposit and withdrawal are therefore a key data point for traders assessing liquidity and access to funds.

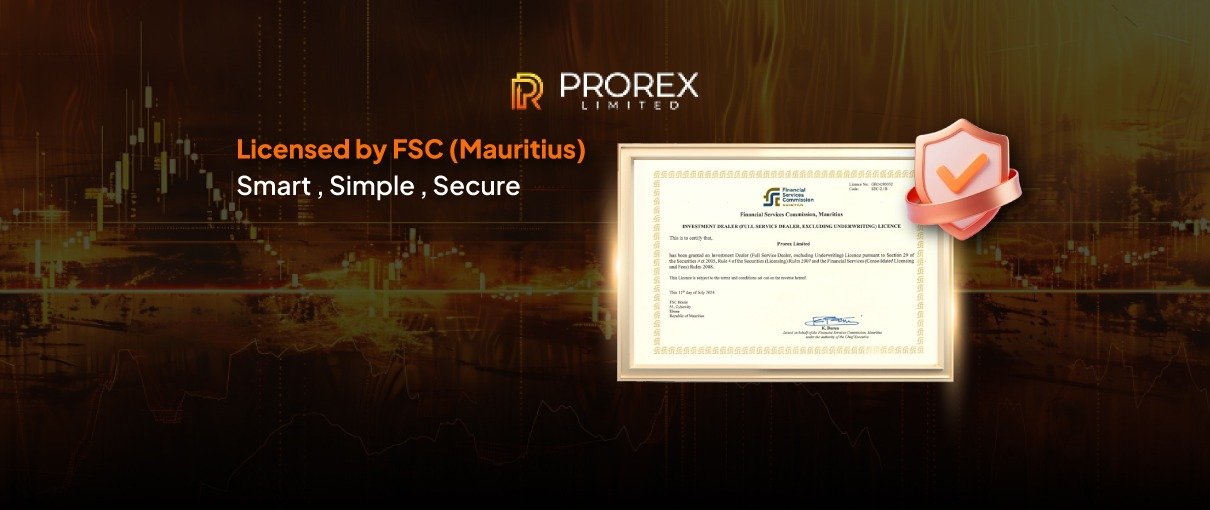

Compliance Alert: Verifying Prorex’s Regulatory Status

A primary concern within the trading community remains security and compliance. The question “Is Prorex regulated?” is a critical point of inquiry. The matter of Prorex regulation is fundamental to user security and operational transparency. Standard due diligence procedure advises that all potential users should personally conduct a Prorex license verification via the public records of the relevant regulatory authority. Traders should carefully examine any Prorex trading bonus, since the company usually attaches specific terms and conditions to these promotions.

The Final Report: Key Takeaways for Today’s Trader

In summary, the prorex forex trading service offers a suite of functionalities for market participants. As competition grows to rank among the best forex trading platforms of 2025, traders should review the facts carefully before opening a Prorex trading account. Key considerations are the platform’s operational stability, the structure of its financial accounts, and, most importantly, its verified regulatory status. This concludes our report.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia