How to Navigate Gold Prices in Indonesia for 2025: A Practical Guide for Smart Investors

August 29, 2024

How to Understand Gold Prices in Indonesia for 2025: A Clear Investment Guide

Gold Price Forecast Indonesia: Gold continues to attract attention in Indonesia as investors look for stability in uncertain times. In 2025, gold prices have remained elevated, drawing interest from seasoned investors and newcomers alike.

This guide will walk you through what’s influencing the market, what analysts expect for the rest of the year, and how you can position yourself as a smart gold investor.

Step 1: What’s the Current Situation with Gold Prices in Indonesia?

Gold prices in Indonesia have remained relatively high through the first half of 2025. While not at historic peaks, they are certainly well above previous years’ levels. This rise is fueled by ongoing economic uncertainty, global inflation concerns, and fluctuations in the Indonesian rupiah.

Many are asking whether these price levels represent a new normal—or a temporary spike before a correction.

Step 2: What Factors Are Driving Gold Prices in 2025?

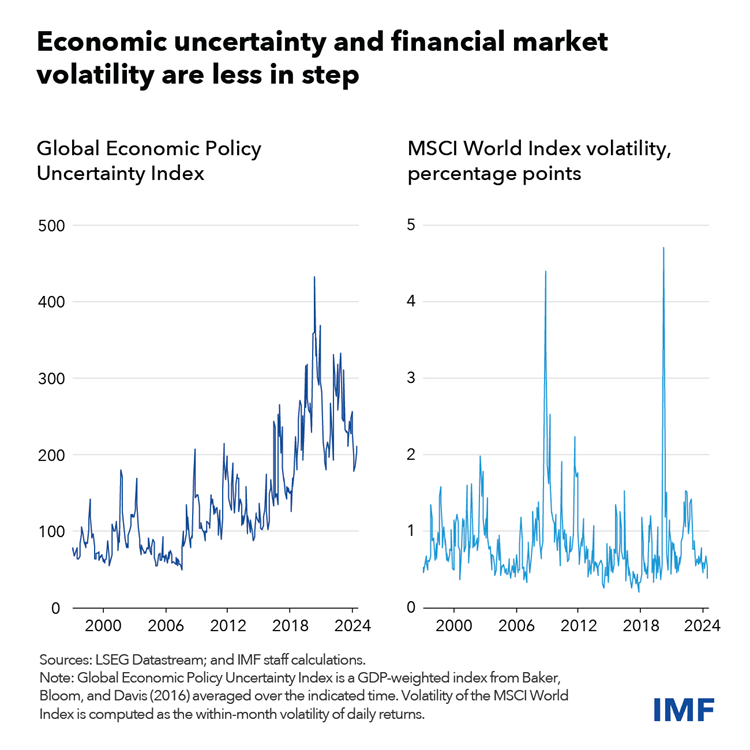

source: How High Economic Uncertainty May Threaten Global Financial Stability

Several key elements are influencing gold prices this year:

- Currency exchange rates: When the rupiah weakens, gold becomes more expensive domestically, even if global prices stay the same.

- Inflation pressure: Although some global regions are seeing relief, inflation still plays a major role in investment behavior.

- Interest rates: Central bank policies—both locally and globally—affect gold’s appeal.

- Geopolitical tensions: Uncertainty surrounding global elections, regional conflicts, and economic policies typically supports higher gold demand.

It’s a complex mix of financial indicators and political developments, both local and international.

Step 3: Gold Price Forecast Indonesia- What Are Experts Predicting for Gold Prices?

Forecasts for the rest of 2025 vary, but the overall tone is steady to cautiously optimistic.

- Optimistic forecasts suggest gold could reach between Rp 1,300,000 and Rp 1,400,000 per gram, depending on demand and global economic factors.

- Conservative forecasts expect prices to hold steady or drop slightly, likely staying in the Rp 1,100,000 to Rp 1,200,000 range, particularly if interest rates increase again.

Most analysts agree that a major crash is unlikely, but dramatic spikes are also not expected.

Step 4: Gold Price Forecast Indonesia- Is It a Good Time for Indonesians to Invest in Gold?

Whether now is a good time to buy gold depends on your investment goals:

- Long-term investors seeking a hedge against inflation or currency depreciation may still find gold attractive.

- Short-term traders should be cautious, as gold can be slow-moving and susceptible to brief pullbacks.

- Physical gold buyers need to consider purchase premiums and potential resale margins when dealing with jewelry or gold bars.

Gold remains more about wealth preservation than quick profits.

Step 5: Gold Price Forecast Indonesia- How Do Global Events Impact Gold Prices in Indonesia?

Gold is a global asset, and international events have local consequences. For example:

- Changes in U.S. interest rates can lead to immediate shifts in global gold prices.

- Increases in Chinese or Indian gold demand can drive up global prices due to supply pressure.

- Major political events or conflict zones can raise demand for safe-haven assets like gold.

- Shifts in Indonesia’s own regulations—such as import taxes or monetary policy—can also affect pricing.

Understanding the global context is essential for anyone tracking local gold prices.

Step 6: Where Can You Track Real-Time Gold Prices in Indonesia?

Reliable, up-to-date information is key for any gold investor. Recommended platforms include:

- Logam Mulia (Antam) – The most trusted source for certified gold pricing.

- Pegadaian Digital – Good for both tracking and investing.

- Bareksa, Pluang, IndoGold – Ideal for app-based investing.

- Tokopedia Emas and Shopee Emas – Popular mobile-friendly options.

- CNBC Indonesia, Kontan, Bisnis.com – Useful for broader financial and market context.

Always cross-check prices before making any purchase or investment.

Step 7: What’s the Outlook for the Remainder of 2025?

The outlook suggests modest gains rather than dramatic movements. While there are no strong signs of a significant rally, gold prices are expected to remain steady, with some potential for gradual increases.

Gold continues to serve its role as a safe and steady asset, especially in a volatile economic environment. If you’re planning to invest, consider it as a long-term commitment rather than a short-term trade.

Final Thoughts

Gold may not offer instant returns, but it still holds long-term value for Indonesian investors in 2025. With inflation, interest rates, and global politics all playing a role, staying informed and thinking long-term is the smartest approach.

This year, gold remains a practical choice for stability in an uncertain world.