Gold Hedge Rupiah: How to Use Gold to Stay Ahead of Currency Risks

October 29, 2024

The term gold hedge rupiah has been circulating more often lately, especially with rising inflation and global economic jitters. And it makes sense — gold has long been seen as a go-to fallback when paper currencies, like the Indonesian rupiah, start losing value.

But how exactly does it work? And how do you actually “hedge” with gold? Don’t worry — this isn’t some complicated trader strategy. Whether you’re saving for the future or just trying not to lose value, here’s a step-by-step guide on how to hedge your money with gold — without overthinking it.

Step 1: Understand What Gold Hedging Actually Means

Let’s keep it real: gold isn’t a magic fix — but it’s a reliable store of value. When the rupiah drops, the IDR price of gold tends to rise because gold is priced globally in US dollars. That’s the basic logic behind the gold hedge rupiah concept: you’re not trying to get rich — you’re trying to stay protected when your currency weakens.

Step 2: Gold Hedge Rupiah: Know When to Consider Hedging With Gold

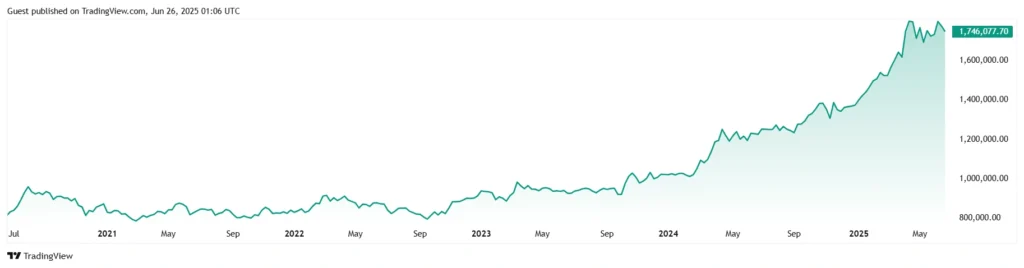

Source: TradingView

Timing isn’t everything, but context matters. Here are some typical warning signs to pay attention to:

- The rupiah is losing ground against the dollar

- Inflation is starting to bite (yep, groceries cost more)

- Global news feels shaky — interest rate hikes, wars, oil prices spiking

- You’re unsure where to park your money long-term

If a few of those boxes are checked? Might be time to think about gold.

Step 3: Gold Hedge Rupiah- Choose Your Gold Format Wisely

Gold comes in more flavors than just shiny coins. You’ve got options:

- Physical gold: Bars, coins, or even jewelry. Feels real — but needs secure storage.

- Digital gold: Platforms like Pluang, Lakuemas, or Tokopedia Emas let you buy gold by the gram — all online.

- Paper gold or ETFs: If you’re into investing, this gives you exposure to gold prices without owning the metal.

Each has pros and cons. If you’re just starting, digital gold is often the easiest entry point — and you can start small.

Step 4: Budget Your Hedge — Don’t Go All In

A common mistake? Pouring everything into gold. Nope. Start slow — 5% to 15% of your savings is a reasonable range. That way, you’re protected and still flexible. Gold doesn’t earn interest, so it shouldn’t replace everything — just act as your financial cushion.

Step 5: Gold Hedge Rupiah- Watch the Costs

You’d be surprised how many people ignore fees. Whether it’s physical or digital gold, always check:

- Buy/sell spreads

- Platform or storage fees

- Delivery charges (if you’re buying bars)

Your gold hedge only works if you’re not getting eaten alive by transaction costs. Compare before you commit.

Step 6: Stay Informed, But Don’t Obsess

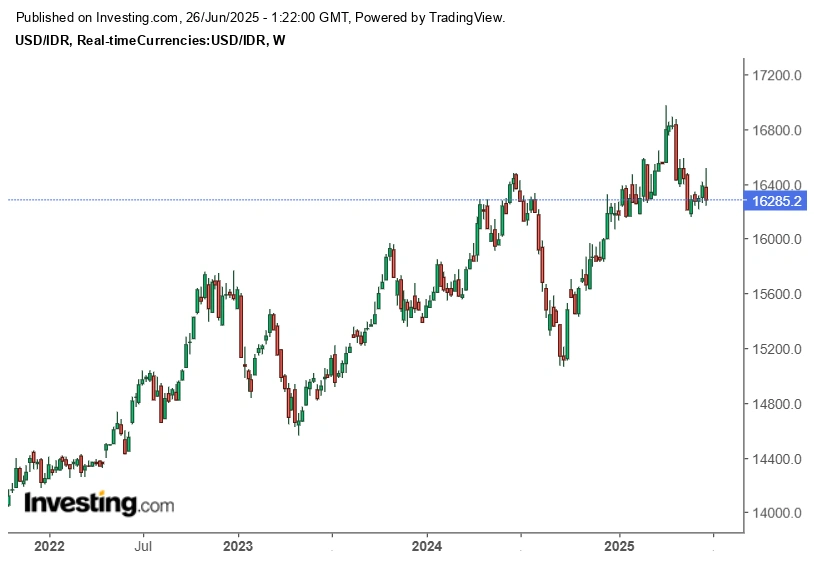

Source: Investing.com

Check gold prices now and then, sure. But don’t refresh the app every 10 minutes — this isn’t a day-trading move. Gold is about the long game. Just keep an eye on key trends like:

- USD/IDR rate

- Bank Indonesia’s policies

- Global gold market news

It’s more about economic shifts than daily ups and downs.

Step 7: Know When to Rebalance or Exit

There may come a time when you feel the rupiah is stable again. Or maybe another opportunity shows up. At that point, it’s okay to sell some gold and move your funds elsewhere. The goal of a gold hedge rupiah approach isn’t to hold gold forever — just while the storm clouds are out.

Wrapping Up

You don’t need to be a financial expert to protect your wealth. With inflation, market noise, and currency risks hanging around, using gold as a buffer just makes sense — especially in 2025.

Start with what you can afford. Monitor the big picture. And don’t stress too much — the point of a gold hedge rupiah plan is peace of mind, not perfection.