How to Navigate Legal Forex Trading in 2025

December 17, 2024

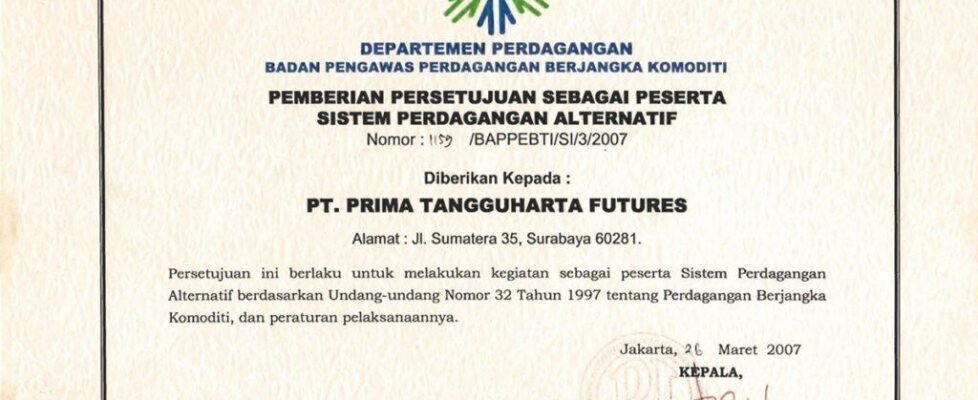

Forex regulation Indonesia: In Indonesia, forex trading is legal—but only under strict regulatory conditions. As of 2025, the practice is allowed and supervised by two main authorities: Bappebti, which handles commodity and futures trading, and OJK, which oversees the broader financial sector.

You’re permitted to trade as long as you use a broker that holds a Bappebti license. This legal setup aims to protect investors from scams and ensure that trading happens within a framework that prioritizes transparency and safety.

Understanding this framework is your first step toward legal forex trading.

Forex regulation Indonesia: Know Why Licensing Matters More Than Ever

Source: FXNEWSGROUP

Not every platform you see online is legal in Indonesia. The rise of mobile apps and social media ads has made forex more accessible, but also harder to regulate. That’s why licensing is the most important aspect of the forex regulation Indonesia applies in 2025.

Only brokers with Bappebti approval are legally allowed to serve Indonesian residents. These brokers meet strict capital requirements, provide clear disclosures, and are subject to regular audits. If your broker isn’t licensed, you’re essentially on your own if something goes wrong.

Before creating an account, always verify the broker’s regulatory status.

Forex regulation Indonesia: Use Official Sources to Check If a Broker Is Approved

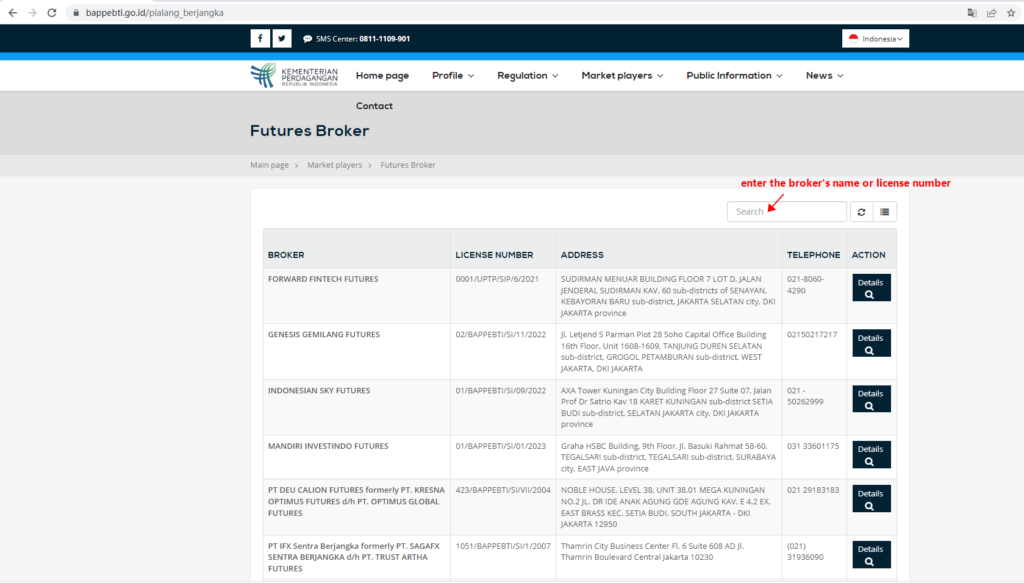

Source: Brokersview

The most reliable way to stay within the law is to cross-check the broker’s license using the Bappebti website. They publish an updated list of approved forex brokers operating legally in Indonesia. If the broker isn’t listed there, it doesn’t matter how polished their platform looks—they’re considered unauthorized.

Some brokers use affiliate links or influencers to promote themselves, so always go beyond the ad and do your own verification. In 2025, many violations involve platforms that look local but are actually offshore entities operating without approval.

Forex regulation Indonesia: Stick With Platforms That Follow Local Trading Guidelines

Source: Linkedin

Legal brokers don’t just operate in Indonesia—they serve Indonesian traders in compliance with local rules. That means offering services in Bahasa Indonesia, providing risk disclosures, and maintaining a physical office in the country.

They’re also required to cap leverage, especially for beginner traders, and avoid marketing that guarantees returns. These limitations aren’t meant to restrict you—they’re in place to create a safer, more informed trading environment.

The right platform won’t promise shortcuts. It will show you how the market works, including its risks.

Avoid the Pitfalls of Using Unlicensed Forex Brokers

Source: FUNDSREFUND

Just because a broker allows you to sign up doesn’t mean it’s legal. Using unlicensed platforms puts you outside of the law—and outside of any protection. If that broker suddenly vanishes or freezes your account, there’s no government agency that can step in to help.

Many unlicensed platforms also offer exaggerated leverage, unclear fee structures, and minimal transparency. In the long run, the risks often outweigh the perceived benefits.

If your goal is consistent, legal trading, steer clear of platforms that haven’t gone through Bappebti’s approval process.

Understand What’s Permitted for Retail Traders

Retail forex traders are allowed to trade as long as they’re doing so through approved brokers. This applies whether you’re trading from your laptop or your smartphone. In 2025, online access is common—but the law focuses on who you trade with, not how.

You can open an account online, make deposits, and begin trading once the platform confirms your identity and account type. Just be prepared for trading limits on leverage, and expect to see clear educational materials provided by the broker.

These rules apply to protect retail investors, especially those new to forex.

Stay Informed as the Regulatory Landscape Evolves

Source: okezone

Forex regulation Indonesia is constantly adapting to the digital nature of the financial market. In recent years, Bappebti has increased its online monitoring, blacklisting foreign brokers, and taking down illegal trading websites. They also work with Kominfo to block access to platforms that operate without a license.

Their website is a useful resource—not just for verifying brokers, but also for reading the latest updates on regulatory changes. Whether you’re a new or experienced trader, it’s worth checking regularly.

Being compliant means staying informed, not just registering once and forgetting the rest.

Conclusion: Trade Smart, Trade Legal

Indonesia’s forex market remains open in 2025—but with firm rules. The forex regulation Indonesia enforces isn’t designed to limit your options, but to ensure that those options are safe, traceable, and fair.

By choosing licensed brokers, verifying compliance, and staying updated on the latest rules, you can engage in forex trading without unnecessary risk. Legal trading isn’t just about avoiding penalties—it’s about protecting your capital and making informed decisions.

Forex may involve risk, but your legal footing doesn’t have to.