Forex Indonesia: A Practical Guide to Understanding Trading and Money Exchange

November 9, 2024

Whether you’re traveling abroad or exploring new ways to grow your finances, currency exchange is something most Indonesians encounter sooner or later. But not all currency services are the same. In Indonesia, the term Forex Indonesia can mean either trading currencies online for profit, or physically exchanging money at a licensed counter. These two services may sound similar, but they serve very different purposes. This article is a practical guide to understanding the difference — and using the right one for your situation.

Forex Indonesia : What Is Forex Trading and Who Uses It?

Forex trading — short for “foreign exchange trading” — involves buying and selling currency pairs like USD/IDR or EUR/JPY through an online platform. It’s part of a global market that operates 24 hours a day, Monday through Friday. The goal is to make a profit when exchange rates rise or fall.

In Indonesia, people usually trade through apps or broker websites. Before you can trade, you must open an account, deposit funds, and learn how the market works. Many traders use charts, news, or technical indicators to make decisions. But unlike a money changer, forex traders never handle physical cash. Everything is digital.

Those who join the forex trading space are usually financially literate, open to risk, and willing to spend time analyzing markets. It’s not gambling — but it’s also not easy. Like any investment, there are ups and downs. That’s why only brokers licensed by BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi) are allowed to operate legally in Indonesia. This keeps the Forex Indonesia environment safe for those who trade responsibly.

Forex Indonesia: What Does a Money Changer Do?

Source: govaluta

A money changer is a business that exchanges physical currencies. You give them Indonesian rupiah and receive another currency — or vice versa. These services are common at airports, shopping malls, and tourist hubs. Unlike forex trading, the goal isn’t to make a profit — it’s to get the money you need for travel, business, or remittance.

People use money changers for clear, immediate needs. Maybe you’re heading to Japan and need yen, or your business just received payment in US dollars. You walk in, check the exchange rate on the board, and swap currencies on the spot. It’s easy, and you leave with the bills in your hand.

All licensed money changers in Indonesia are regulated by Bank Indonesia. This ensures fair pricing, receipt issuance, and proper customer identification. In the context of Forex Indonesia, money changers represent the simple, practical side of currency exchange — designed for users who want speed, transparency, and cash in hand.

Forex Indonesia: Key Differences Between Forex Trading and Money Changers

Source: Adaremit

The biggest difference lies in purpose. Forex trading is speculative. People join the market with the aim of making money from rate changes. This means it involves strategy, timing, and risk — just like investing in stocks or commodities.

Money changing, on the other hand, is purely transactional. It’s about converting currency for a clear reason, such as a holiday or school payment abroad. There’s no speculation — you exchange your money at a posted rate and move on.

Forex trading also requires digital tools and platforms. You need a device, internet access, and trading knowledge. In contrast, money changers are physical outlets that are usually quick and easy to access — no apps or charts involved.

In short, Forex Indonesia today consists of two distinct tracks: one focused on market participation and one centered around real-life utility.

When to Use a Money Changer

Source: Kontan

If your goal is to obtain physical foreign currency, a money changer is the best solution. Whether you’re buying USD for a trip or converting AUD sent from family abroad, this service is direct and reliable. You know what you’re getting, and the process is done in minutes.

Money changers are also good for people who aren’t comfortable with technology or who simply prefer personal interaction. In many cases, the slight difference in exchange rate is worth the convenience and peace of mind. For practical, one-time needs, money changers remain a core part of the Forex Indonesia system.

When to Use Forex Trading

Source: panrb

If you’re curious about financial markets, have time to learn, and are willing to take calculated risks, forex trading can be a valuable skill. Many Indonesians start small, using demo accounts or placing small trades before committing larger amounts.

It’s important to set realistic goals. Forex trading won’t make you rich overnight, but it can become part of a diversified financial plan. Just remember to use only brokers that are licensed by BAPPEBTI. That’s your guarantee that the platform is operating within Indonesia’s financial regulations.

In this part of Forex Indonesia, education is key. Don’t rush in — take time to learn, test your strategy, and manage your risk.

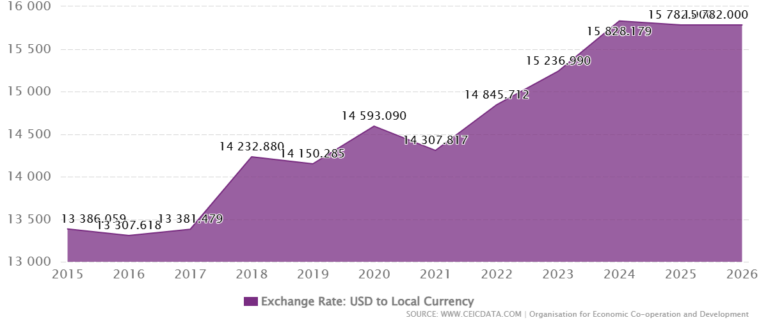

Why Exchange Rates Vary

Source: ceicdata

Rates at money changers often include a margin — that’s how they earn their profit. Some places may offer better rates than others, depending on location and the currency being exchanged. For example, rates at a money changer in a Jakarta shopping mall might be better than those at an airport.

Forex trading platforms, meanwhile, reflect live interbank rates, which are constantly changing. These are closer to real-time market values, but they also come with spreads and sometimes commission fees. For larger amounts or frequent transactions, trading may give you a better rate — but it also involves more effort and more risk.

How to Stay Legal and Safe

Source: mobee

No matter which service you use, legality and safety come first. For forex trading, always choose a broker registered with BAPPEBTI. You can check their website to see which platforms are officially licensed.

For money changers, look for outlets registered under Bank Indonesia. They should display their license and provide a printed receipt for each transaction. Avoid any provider — online or offline — that operates without proper registration. Being cautious helps you avoid fraud and ensures your experience with Forex Indonesia is secure.

Conclusion: Making the Right Choice

In the end, choosing between forex trading and a money changer comes down to your needs. If you need currency for a trip, transaction, or business, a money changer is your go-to. If you’re exploring market opportunities and are ready to handle risk, forex trading may offer long-term value.

Both services are part of the growing Forex Indonesia landscape. Understanding how they work — and when to use each — gives you the confidence to make better decisions with your money.