How to Choose Between Day Trading and Swing Trading in Indonesia

January 1, 2025

Day Trading Indonesia: In the Indonesian context, day trading is more than just a fast-paced trading style — it’s a routine that revolves around short windows of opportunity. Traders enter and exit positions within the same trading day, often in minutes. With access to digital stock platforms and forex brokers in Indonesia, this method has gained traction, especially among those looking to capitalize on small price movements multiple times a day. Still, it’s not just about speed — day trading requires discipline, a sharp reaction time, and a focused strategy tailored to volatile markets like forex or IDX-listed stocks.

Get Familiar with Swing Trading and Its Flexibility

Swing trading offers a contrasting rhythm. Rather than watching every tick, swing traders in Indonesia analyze broader trends and typically hold trades for a few days to weeks. It’s a style that suits those who prefer nightly chart analysis over live action. Using tools like candlestick patterns, moving averages, or support-resistance zones, traders try to catch medium-term price swings. With Indonesia’s varied internet access and working schedules, swing trading offers a practical entry point for those who want a more measured approach — less stress, but still engaged.

Compare Time Requirements Based on Your Schedule

Source: ThoughtCo.

Time is a major decision factor. Day trading in Indonesia requires consistent, concentrated blocks of time during market hours. That means being in front of the screen and reacting to news, signals, or technical shifts quickly. It can be intensive, making it suitable for traders who can commit hours each day. Swing trading, on the other hand, gives more room to breathe. You can analyze charts after work or during the weekend, making it a preferred method for those with full-time jobs or family obligations. The question is — do you want trading to fit around your life, or your life around trading?

Understand the Emotional Load of Both Styles

Source: iStock

Trading isn’t just about numbers. Emotional resilience plays a big role. With day trading, your stress levels can climb quickly. Price changes happen fast, and losing or winning within minutes can shake your confidence. In Indonesia, where trading communities are often active on social media, peer pressure and FOMO can heighten that tension. Swing trading offers a slower pace, giving traders time to review and reassess without pressure. If you’re more comfortable with thoughtful planning than quick-fire reactions, swing trading may feel less emotionally draining.

Day Trading Indonesia: Examine Profit Potential and How Often You’ll Trade

Source: iStock

Are you in it for fast gains or more consistent setups? Day traders often place many trades per day, aiming for small but frequent wins. If you’re trading through Indonesian brokers or international platforms, costs like fees or spreads add up. That’s something to factor in. Swing traders typically place fewer trades, targeting larger moves with higher reward-to-risk ratios. This could mean holding one or two trades per week. For traders in Indonesia who want to limit exposure to volatility or reduce overtrading, swing trading offers a cleaner pace.

Day Trading Indonesia: Consider Your Strategy Fit in the Forex Market

Source: Futunn

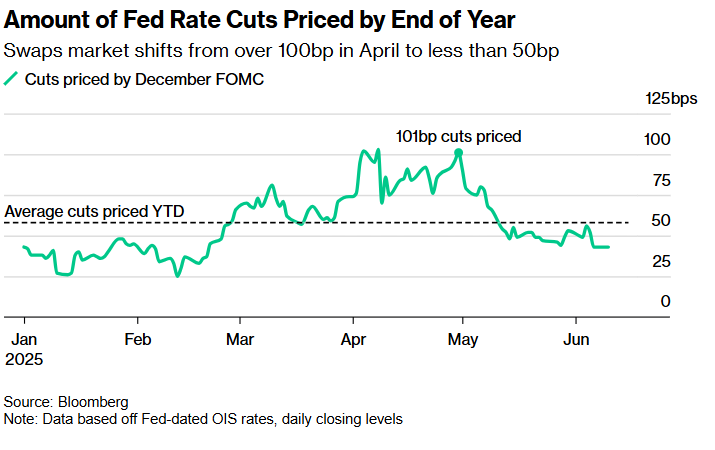

Forex remains popular among Indonesian traders, and it works for both styles. Day trading Indonesia’s forex market means tracking hourly or minute-based movements, reacting to global events like U.S. interest rate shifts or regional trade announcements. Swing trading forex, by contrast, revolves around broader trends. You might hold EUR/USD for several days based on a moving average crossover or divergence signal. Your style should match your analytical approach — quick chart scanning and reflexive trades, or detailed pattern recognition with longer timeframes.

Day Trading Indonesia: Align Your Trading Style with Personality and Lifestyle

What kind of decision-maker are you? Are you intuitive and reactive, or methodical and patient? Day traders often thrive under pressure and enjoy rapid decision-making. They’re fine with logging in daily and adjusting frequently. Swing traders lean toward planning, patience, and trend-watching. Many Indonesians balance trading with school, business, or caregiving, making swing trading more realistic for those needing flexibility. The most successful traders aren’t just skilled — they’re self-aware. Knowing your rhythm helps align your trading with your real-life pace.

Try Both in Simulation Before Committing

If you’re not sure which fits best, try both — but do it with a clear structure. Use demo accounts offered by Indonesian brokers or global platforms. Try day trading for a week, then switch to a swing trading routine. Track your mental focus, outcomes, and how it fits into your lifestyle. Some Indonesian traders eventually blend both, day trading forex while swing trading stocks or crypto. Starting small gives you room to observe and adapt without high risk. The goal is progress, not perfection.

Final Step: Let Your Strategy Grow With You

Whether you begin with day trading Indonesia-style or lean into swing trading, remember that your trading journey will evolve. Some traders start with swing setups, develop discipline, and then move into day trading when time allows. Others try day trading and later realize swing trading is more sustainable long-term. There’s no one-size-fits-all formula — only the one that fits your goals and lifestyle right now. And as your skills and confidence grow, your strategy can shift too.