Mastering BI Forex Intervention in 2025: How Bank Indonesia Handles Exchange Rate Pressures

November 6, 2024

Introduction: Why Forex Intervention Still Matters in 2025

Even in 2025, with financial systems becoming faster and more globalized, exchange rates are rarely left entirely to market forces. BI forex intervention refers to how Bank Indonesia steps into the foreign exchange market to manage the value of the Indonesian rupiah. With capital flows shifting rapidly in and out of emerging markets, a single global event can send currencies swinging. That’s why understanding how BI intervenes—and why—is essential in today’s economy.

Step 1: Define BI Forex Intervention

Source: TradingEconomics

To start, BI forex intervention is Bank Indonesia’s set of strategies for limiting excessive volatility in the rupiah. This doesn’t mean the central bank fixes the currency at a set level. Instead, it manages disruptive swings, especially during times of global uncertainty or market overreaction. In 2025, this has become even more critical, as inflation risks, commodity price shifts, and global interest rate adjustments create ripple effects throughout Southeast Asia.

Step 2: Know Why It’s Used

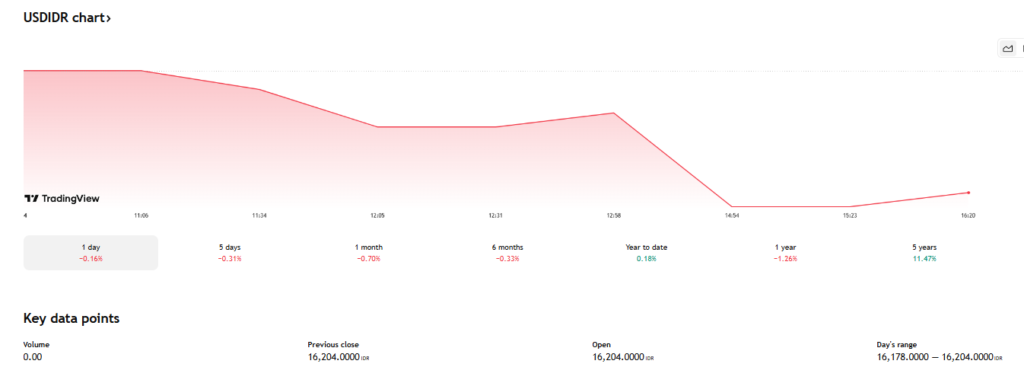

Source: TradingView

Bank Indonesia’s mandate is to maintain monetary and financial system stability—and that includes defending the rupiah when necessary. When foreign capital flows out of the country or speculation hits the market, the rupiah can weaken quickly. In response, BI intervenes to prevent this volatility from spreading into inflation or eroding business and consumer confidence. In 2025, BI forex intervention continues to serve as a safeguard for economic continuity.

Step 3: Learn the Tools of Intervention

Bank Indonesia doesn’t just rely on a single method. It uses several technical tools to stabilize the market:

- Spot Market Transactions: Selling or buying U.S. dollars to support or cool down the rupiah.

- Domestic Non-Deliverable Forwards (DNDFs): These contracts allow businesses to hedge future rupiah positions, which reduces speculation.

- Use of Foreign Reserves: BI taps into its USD reserves to provide liquidity when needed.

- Open Market Operations: Including interest rate management to influence capital inflows and outflows.

In 2025, DNDF usage has expanded as a preferred tool for managing expectations without disrupting real-time market pricing.

Step 4: Understand When BI Acts

Bank Indonesia doesn’t intervene every time the rupiah moves. But when the market becomes too volatile or investor behavior turns speculative, it acts swiftly. In 2025, this was visible in early Q2 when global risk-off sentiment led to a sharp dip in the rupiah. BI quietly intervened by selling dollars and offering DNDF contracts to stabilize the market. Timing is key—intervening too late or too aggressively could make things worse, so the bank acts with calculated precision.

Step 5: Measure the Effectiveness of Intervention

The goal of intervention isn’t to eliminate movement but to manage it. By reducing sharp, emotional reactions in the forex market, Bank Indonesia can guide the rupiah into a more stable range. In 2025, this has been evident as the rupiah maintained a relatively narrow band despite external pressures. Businesses were able to price goods more confidently, and inflation remained within the central bank’s target range. That’s a sign that intervention is working as intended.

Step 6: Consider the Balance Between Secrecy and Transparency

BI keeps its tactical interventions mostly confidential—part of a strategy to avoid giving away too much information to currency speculators. However, it balances this with clear communication on its broader monetary policy direction through speeches, monetary policy reports, and market briefings. In 2025, this approach helps maintain trust without compromising flexibility. Market players understand that BI is watching, even if its actions aren’t always headline news.

Step 7: See the Impact on Everyday Life

Source: Reuters

While forex policy may seem distant to many Indonesians, the outcomes are anything but. A stable rupiah keeps fuel and food prices manageable, protects against imported inflation, and helps businesses plan for the future. In 2025, BI forex intervention has played a direct role in preventing large price spikes at a time when global costs remain unpredictable. The result? A smoother economic path for households, SMEs, and exporters alike.

Conclusion: BI Forex Intervention Remains a Vital Stabilizer in 2025

In a world of rising uncertainty, BI forex intervention in 2025 is more than just a technical response—it’s a central part of Indonesia’s financial resilience. With the rupiah exposed to global trends beyond the country’s control, Bank Indonesia’s active role in the forex market provides much-needed stability. By applying timely strategies with the right tools, BI keeps the currency on track, the markets calm, and the economy protected. As investors and citizens alike navigate a changing world, knowing how BI manages the rupiah is knowledge worth having.