Your Broker Hates This: Discover the Prorex Trading Signals That Are Making Independent Traders Rich

September 19, 2025

September 20, 2025 — In the rapidly evolving landscape of financial technology, retail traders are increasingly adopting automated analytical tools to navigate market volatility. A notable development in this sector is the growing utilization of Prorex trading signals. A system designed to deliver data-driven market alerts directly to users. The service aims to distill complex market analysis into actionable information. This report provides a factual overview of the system’s functionality. Its practical application in current trading environments, and the infrastructure that supports it.

Content

Analysis: A Closer Look at Prorex Trading Signals Functionality

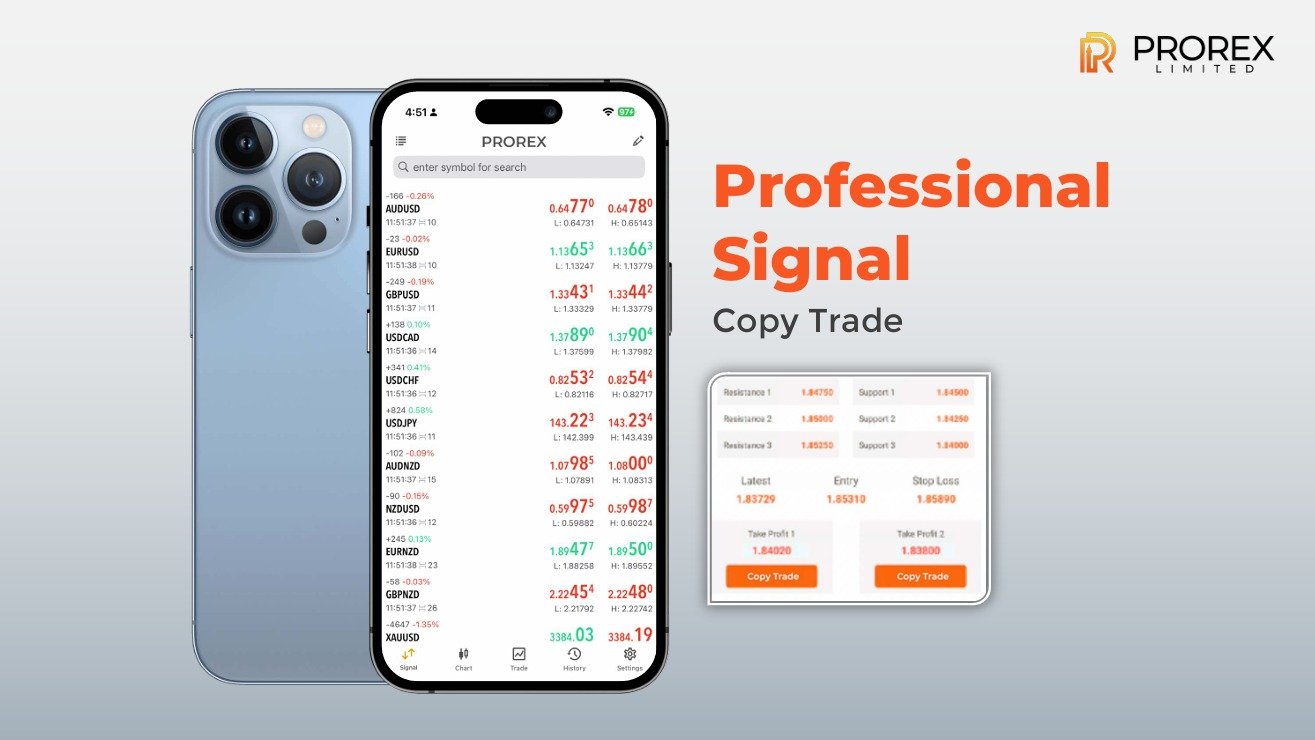

An examination of the Prorex trading signals reveals a system based on algorithmic analysis of real-time market data. The core function involves processing numerous variables, including price action, volatility, and key technical indicators, to identify potential trading opportunities. These generated prorex signals are then disseminated directly to clients through the integrated Prorex trading platform. The objective is to provide traders with timely and relevant data points. Which can then be used to inform their own market assessments and strategic decisions. The system is engineered for speed, aiming to reduce the latency between analysis and information delivery.

Market Usage of Prorex Forex Signals in Trading Protocols

Current market observation indicates that traders are integrating Prorex forex signals into their established trading protocols in several distinct ways. Primarily, the signals are being employed as a confirmation mechanism. Instead of initiating trades based solely on an alert, traders are using the signals to validate their own independent analysis before committing to a prorex investment. This use case is prevalent in the prorex online trading community as a method for enhancing decision-making confidence. The signals are thus functioning as a supplementary data source within a broader, discretionary trading strategy rather than as a fully automated solution.

Brokerage Infrastructure and Regulatory Standing

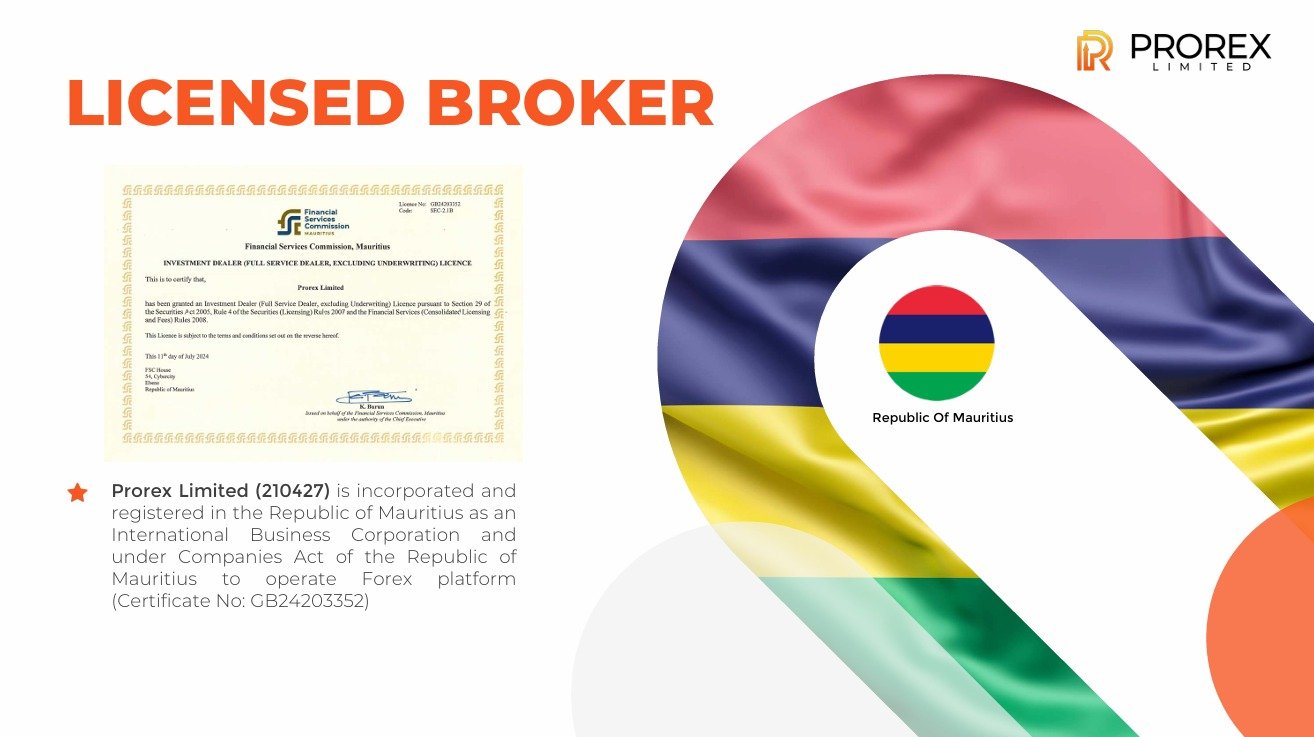

The effectiveness of any trading tool is contingent upon the underlying platform’s infrastructure. Key operational details for the Prorex platform have been noted. The brokerage maintains a competitive prorex spread on major asset classes, a factor that directly impacts transaction costs. Furthermore, the firm’s adherence to prorex regulation provides a structural framework for its financial operations, a standard consideration for market participants. A range of prorex account options are available to accommodate varying trader needs, and a prorex trading bonus is periodically offered, subject to specified terms and conditions. These factors constitute the operational environment in which the signals function.

Outlook for 2025: The Signal Provider Landscape

As the industry continues its evaluation of the Best forex signal providers 2025. The focus is increasingly on the integration and reliability of their offerings. The utility of tools like Prorex trading signals will be assessed based on their consistency. The robustness of the data analysis, and the overall stability of the platform. The prevailing trend suggests a sustained demand for sophisticated analytical support tools among the global retail trading population, with an emphasis on platforms that provide a comprehensive and secure trading ecosystem.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia