The Unseen Revolution: Prorex Pamm Trader and the New Face of Trading

February 14, 2025

In financial circles, conversations about innovation rarely stay quiet for long. One concept that keeps surfacing in 2025 is Prorex Pamm Trader—a model that’s quickly becoming part of the broader conversation on how investors interact with forex markets. The rise of PAMM accounts isn’t just a passing headline; it reflects a deeper trend toward transparency, structured portfolio management, and technology-driven investing.

Why Prorex Pamm Trader Is Gaining Attention Now

The current generation of investors faces an unusual challenge: endless information but limited time. With global events moving markets at lightning speed, many individuals are looking for ways to engage in forex trading without being chained to their screens. This is where Prorex Pamm Trader fits neatly into the larger trend. It allows clients to allocate funds to professional managers, distributing results proportionally while keeping investors in full view of how fees and performance are structured.

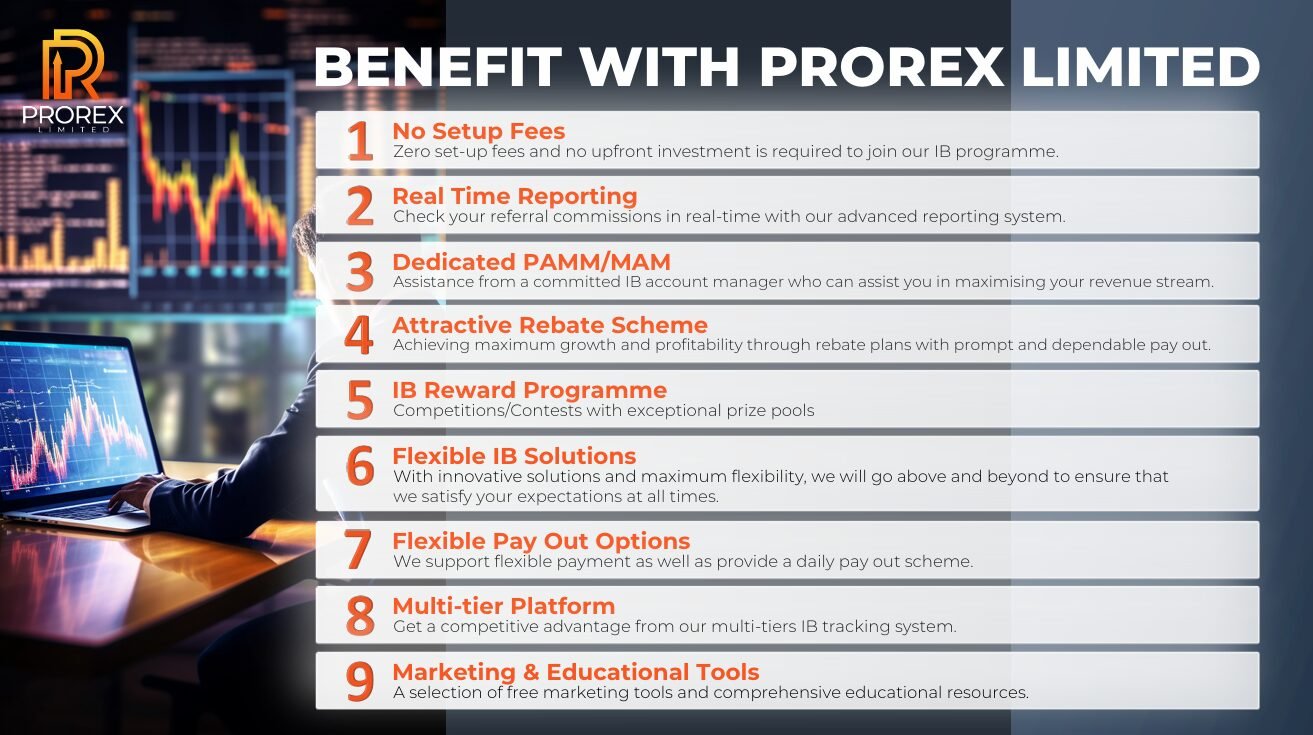

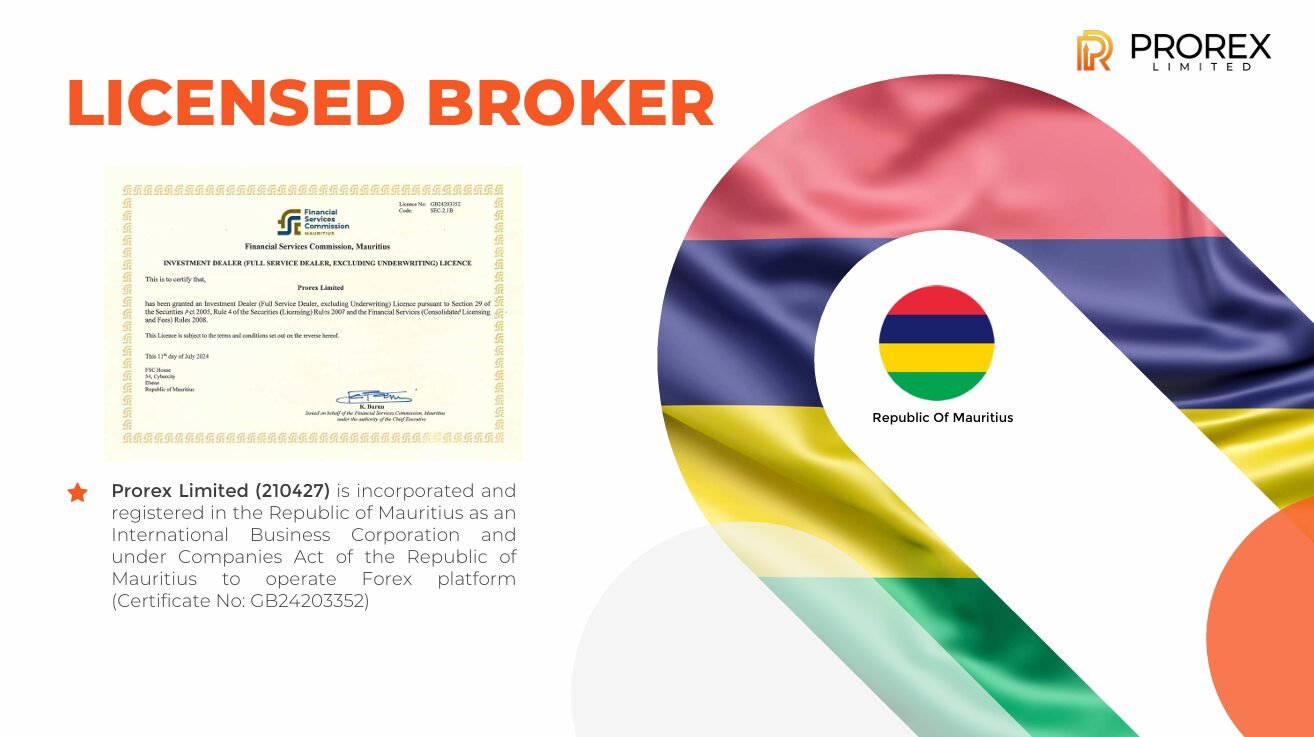

By operating under regulatory oversight in Mauritius, offering ultra-low spreads, and integrating seamlessly with MetaTrader 5, Prorex adds credibility to a model that appeals to time-poor professionals as much as it does to ambitious beginners. This ability to combine structure with accessibility explains why PAMM accounts are becoming a growing part of the forex discussion.

Prorex Pamm Trader vs. Copy Trading in a Shifting Landscape

Another emerging theme in trading trends is the distinction between passive models. Copy trading remains popular for those who prefer a one-to-one mirroring of trades. However, Prorex Pamm Trader provides something different—pooled fund management, where performance is distributed fairly among investors. This approach feels less reactive and more strategic, appealing to those who want their portfolios aligned with defined methods rather than the volatility of individual trades.

The fact that Prorex offers both models—PAMM and copy trading—demonstrates an awareness of changing investor expectations. Flexibility has become the hallmark of modern brokers, and Prorex’s dual system ensures that clients can choose whichever suits their evolving goals.

The Broader Trend: From Risk to Transparency

If one trend defines financial markets in 2025, it is the demand for clarity. Investors are less interested in hype and more concerned with trust. Through Prorex Pamm Trader, this demand is met by transparent reporting, customizable performance fees, and detailed access to strategy providers’ histories. Instead of uncertainty, investors gain tools to make measured decisions. Whether diversifying across multiple managers or tracking results in real time.

This emphasis on openness also empowers fund managers. Giving them opportunities to build their reputation and connect with investors on fair terms. In turn, clients benefit from a dynamic ecosystem that thrives on accountability, not guesswork.

Conclusion: Prorex Pamm Trader and the Path Forward

As trendwatchers continue to scan the horizon of forex trading, one fact stands out. Prorex Pamm Trader isn’t just a feature, it’s a signal of where the industry is heading. By blending transparency, regulation, and cutting-edge technology, Prorex is setting a tone for the future of portfolio management. In a year defined by rapid shifts and heightened expectations, PAMM accounts are no longer niche. They’re becoming a central part of the conversation about how investors want to engage with global markets.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia