Vietnam Crypto Adoption Explained: FAQs About the World’s 5th Largest Crypto User Base

October 20, 2024

Vietnam Crypto Adoption FAQs: Understanding the Country’s Rise as a Global Crypto Leader

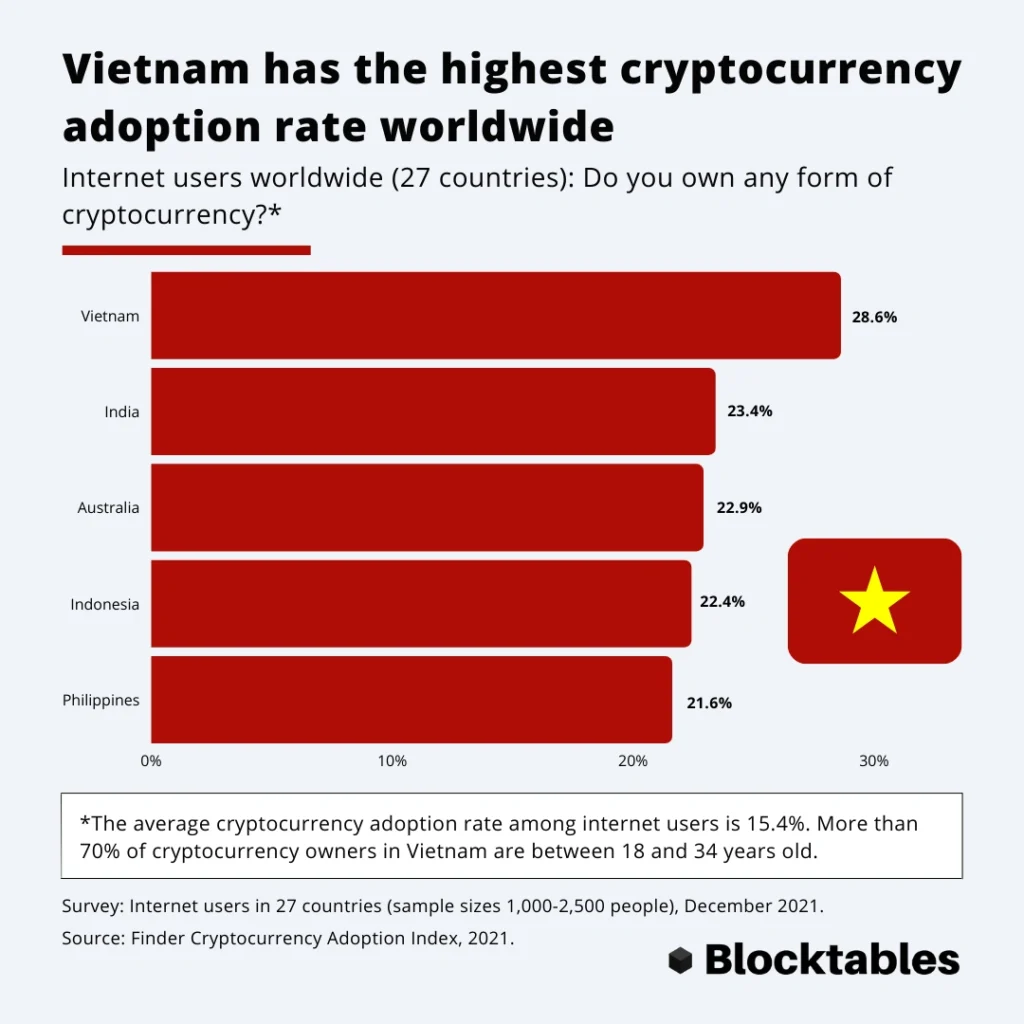

In recent years, few countries have demonstrated a more dynamic and widespread integration of cryptocurrency into everyday life than Vietnam. The latest 2024 Global Crypto Adoption Index, published by Chainalysis, places Vietnam at number five globally, reflecting how far the country has come in just a few short years.

This isn’t just about impressive transaction volumes or speculative trading. Vietnam’s rise in the crypto space is largely grassroots in nature, meaning it stems from how ordinary people are using digital assets to solve everyday financial challenges—from sending money across borders to saving outside the banking system. In this FAQ-style guide, we’ll unpack the key questions surrounding Vietnam crypto adoption, explore what’s driving it, and discuss what it might mean for the country’s future in the digital economy.

Why has Vietnam emerged as a global crypto adoption leader?

Credit from InCorp Vietnam

Vietnam’s high ranking may surprise some, but it makes sense when you consider how people are using crypto within the country. Unlike some markets where adoption is largely driven by speculation or institutional activity, Vietnam’s usage is practical and widespread.

One of the biggest factors is the volume of remittances flowing into the country. Every year, Vietnamese workers abroad send home more than $16 billion, making Vietnam one of the top remittance-receiving countries globally. Many families rely on these funds for daily expenses. For them, crypto offers a faster, cheaper alternative to traditional money transfer services. Stablecoins like USDT, in particular, have become a popular way to move funds with less friction and fewer fees.

Another key driver is limited access to traditional banking in rural areas. Many Vietnamese—especially in the countryside—don’t have easy access to bank branches or financial services. For this population, digital currencies provide a practical solution: an internet-connected phone is all that’s needed to store, transfer, or even grow savings in crypto form.

In addition, Vietnam has a young, tech-savvy population. With high mobile usage and digital literacy, particularly among millennials and Gen Z, interest in crypto has grown rapidly—especially in areas like play-to-earn gaming and decentralized finance.

What are people in Vietnam actually doing with crypto?

Credit from Asia Crypto Today

It’s not just about investing in coins or holding Bitcoin in a digital wallet. Vietnamese users are embracing a wide range of crypto applications. Many are using stablecoins for cross-border payments or domestic savings. Others are diving into DeFi platforms to borrow, lend, or earn yields on their assets—often with more favorable terms than traditional institutions offer.

Gaming is another important part of the story. Vietnam was the birthplace of Axie Infinity, a global play-to-earn phenomenon that, at its peak, brought in millions in daily transactions. While the hype surrounding blockchain gaming has cooled in recent months, the infrastructure and developer community it helped build continue to thrive.

Meanwhile, small business owners and freelancers are increasingly open to accepting crypto payments—especially when working with international clients. In many cases, crypto provides speed and flexibility that traditional finance can’t match.

How has the Vietnamese government responded to the crypto boom?

Credit from SOCIALIST REPUBLIC OF VIET NAM Government News – Báo Chính phủ

Vietnam’s regulatory stance on crypto has evolved noticeably over the past several years. In 2017, authorities banned crypto as a legal payment method, but didn’t prohibit investment or holding. This created a kind of legal gray area, where usage quietly flourished without strong regulatory oversight.

That ambiguity began to shift in 2025, when the Vietnamese government passed the Digital Technology Industry Law, a landmark move that formally recognizes both virtual and crypto assets under Vietnamese law. The new framework, which takes effect in 2026, sets out clearer definitions, encourages innovation, and opens the door to licensed exchanges, tax collection, and formal market infrastructure.

Government support is now more visible. A prime ministerial directive has already launched a pilot program for centralized crypto exchanges, and the Vietnam Blockchain and AI Innovation Academy, established in 2024, aims to train over a million blockchain professionals. These steps signal a clear intention: Vietnam wants to become not just a participant in the digital economy, but a regional leader in blockchain development.

Is Vietnam’s crypto growth without risks?

Credit from BBC

Like any rapidly evolving sector, Vietnam’s crypto expansion comes with challenges. One of the most pressing is security and fraud prevention. The infamous Axie Infinity hack in 2022, which resulted in the loss of $620 million, was a wake-up call for the global crypto community—and especially for Vietnam’s blockchain scene.

There are also concerns from public authorities. Law enforcement agencies have reported instances where foreign actors attempted to exploit the anonymity of crypto transactions to funnel money through Vietnam. While the scale remains unclear, it’s enough to prompt calls for stronger regulatory enforcement.

Another issue is investor protection. Despite the enormous user base, Vietnam has only prosecuted two crypto-related fraud cases since 2017. This points to a lack of capacity in enforcement, even as adoption continues to climb. The hope is that the incoming legal framework will help close these gaps and give users greater confidence.

How big is Vietnam’s crypto economy right now?

The numbers tell a remarkable story. In 2023 alone, $120 billion in crypto flowed through Vietnam—more than a quarter of the country’s entire GDP. According to some estimates, Vietnam accounts for about 5% of global trading volume, despite being a developing market.

There are more than 20 centralized exchanges operating locally and over 1,000 active crypto-related communities across platforms like Telegram and Facebook. Even a minimal 0.1% transaction tax could generate $800 million annually in state revenue, according to expert estimates.

More importantly, crypto is generating jobs and attracting international interest. Vietnam has become a favored destination for outsourced blockchain development, thanks to its strong tech talent and competitive labor costs.

What’s next for crypto in Vietnam?

Vietnam’s future in the crypto space appears increasingly structured, with regulatory support gaining momentum and local ecosystems continuing to grow. As the new laws take effect in 2026, more legitimate platforms and institutional players are likely to enter the market. This will not only increase user protections but also attract capital and partnerships.

What’s particularly promising is that Vietnam’s crypto story isn’t based on hype—it’s based on need. Whether it’s a family receiving remittances, a student earning crypto through gaming, or a rural vendor managing savings through a mobile wallet, digital assets are addressing real challenges.

This sets Vietnam apart from many other markets where adoption is still largely speculative. It also offers a valuable model for other developing countries looking to embrace innovation while protecting users.

Conclusion: Vietnam’s Crypto Adoption Is Just Getting Started

Vietnam’s fifth-place ranking in the 2024 Chainalysis Global Crypto Adoption Index is no fluke. It’s the product of years of organic growth, economic adaptation, and technological experimentation. The country has managed to integrate cryptocurrency into the daily lives of millions—whether for remittances, investing, or innovation—without the luxury of perfect infrastructure or full regulatory clarity.

As new policies take shape and digital financial tools become more accessible, Vietnam crypto adoption will likely remain one of the most watched trends in global finance. For now, it’s clear that this Southeast Asian nation is not just participating in the crypto revolution—it’s helping to shape it.