Building a Powerful Trading Journal Indonesia: A Step-by-Step Guide for Smarter Trades

April 7, 2025

Trading Journal Indonesia: A trading journal is a structured way to track all your trading activity—entries, exits, strategy, emotional state, and outcomes. It’s not just a log of numbers but a personal feedback system that helps traders become more strategic and consistent. In the context of Indonesian markets, where volatility in forex, stocks, and crypto can be high, a trading journal plays a vital role in avoiding impulsive trades and staying focused on long-term strategy. It transforms trading into a process that can be evaluated, refined, and improved over time.

How to Start Your Own Trading Journal

Creating your own trading journal can be as simple or advanced as you like. You can begin with a basic spreadsheet or choose a specialized platform depending on your trading style. At the core, you’ll want to include information such as:

- Date and time of the trade

- Instrument traded (e.g., forex pair, stock ticker, crypto asset)

- Entry and exit prices

- Stop-loss and take-profit levels

- Strategy or setup used

- Result (profit or loss)

- Personal notes, including emotional state or hesitation

For many traders in Indonesia, tools like Microsoft Excel or Google Sheets are a great starting point. They’re free, customizable, and easy to use. If you prefer something more automated, apps like Edgewonk, Trademetria, or CoinMarketMan can provide dashboards and performance reports.

Tailoring Your Journal for the Indonesian Market

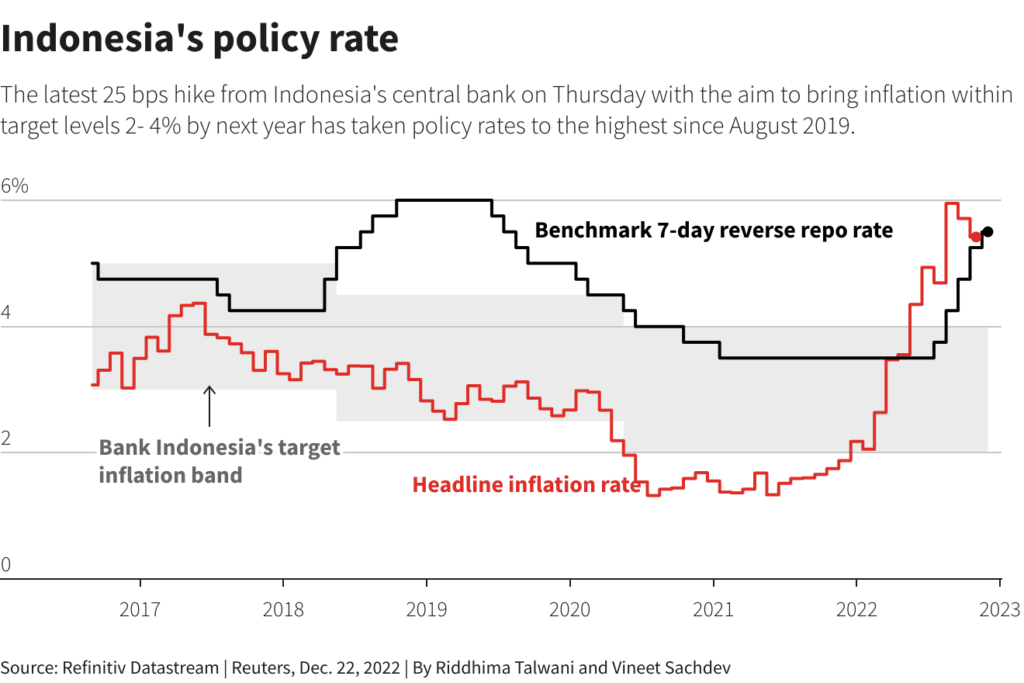

Source: Reuters

When trading in Indonesia, there are specific factors to consider. Local equities on IDX, forex pairs against IDR, and crypto assets listed on local exchanges (like Tokocrypto or Pintu) all have unique trading conditions. It’s helpful to record:

- The platform or broker used (for identifying platform-specific fees or delays)

- Trading session (Asian, European, or U.S. overlap)

- Economic news from Bank Indonesia or regional updates

- Internet performance during trade (especially important if you trade via mobile)

These additional notes help you build a more context-aware journal that reflects real trading conditions in Indonesia.

Trading Journal Indonesia: Reviewing Your Trades and Spotting Patterns

Source: Strike

Your trading journal is only useful if you take time to review it. Set aside a regular schedule—weekly or monthly—to go through your past trades and analyze the data. Look for trends: are you more successful trading in the morning or afternoon? Does a specific strategy work better in volatile markets? Are emotional trades resulting in more losses?

Over time, you’ll discover your personal edge and your most common mistakes. This feedback loop is what turns a trading journal from a record-keeping tool into a growth engine.

Trading Journal Indonesia: Examples of Effective Trading Journals

If you’re unsure how to structure your journal, start with a downloadable template. Many Indonesian traders use Google Sheets templates that already include columns for price movement, risk-reward ratio, and emotional tags. You can also embed screenshots of your charts in a visual journal format using tools like Notion. For crypto traders, journals that track gas fees, slippage, and funding rates are especially useful.

Trading Journal Indonesia: Staying Consistent with Your Journal

Source: FBS

The most important habit is consistency. A trading journal won’t work if it’s only updated occasionally or only when trades go well. Commit to filling it out for every trade, win or lose. Set a reminder after each session or keep the journal open as you trade. If you’re a mobile trader, consider using cloud-based notes or apps that sync across devices so you can journal on the go.

Conclusion: Turn Documentation into Progress

A trading journal is more than a tracker—it’s a teacher. It shows what works, what doesn’t, and how you behave under pressure. For traders in Indonesia, maintaining a journal that reflects local market conditions and your personal strategy is an investment in long-term success. Whether you use Excel, mobile apps, or pen and paper, the key is to be honest, consistent, and reflective. By documenting your journey, you take control of your development and increase your odds of becoming a consistently profitable trader.