Trading Psychology Indonesia: How Mindset Shapes Success for Beginner Traders

February 25, 2025

Trading psychology Indonesia: Most beginner traders in Indonesia start by focusing on technical tools or strategies. But sooner or later, they hit a wall — not because their strategy fails, but because their mindset does. Trading psychology Indonesia is the mental framework that allows traders to execute consistently, even under stress. Emotions like fear, greed, hesitation, or overconfidence can lead to poor decisions if left unchecked. Mental discipline is not about being emotionless; it’s about understanding your reactions and staying rational even when the market turns against you.

Discipline and Structure: Trading psychology Indonesia- The First Step to Mastery

One of the most powerful psychological tools a trader can develop is discipline. This means sticking to a trading plan, even when temptation arises to deviate. For many Indonesian traders, setting clear entry and exit rules, defining stop-loss levels, and maintaining position size are technical steps—but they only work if the trader has the discipline to follow them. Without this mental commitment, no strategy can deliver consistent results. Having structure in your trading prevents impulsive actions, which are often driven by fear or frustration.

Trading psychology Indonesia: Understanding and Controlling Fear & Greed

Source: ICMarketsGlobal

Fear and greed are the two most dominant emotions in trading. Fear makes you exit too early, while greed keeps you holding on too long. Beginner traders often experience a rollercoaster of these emotions—cutting winners short because they fear reversal, or chasing trades they shouldn’t because they fear missing out. Developing trading psychology Indonesia means learning to pause before reacting. Ask yourself: “Am I following my plan or my emotion?” That moment of self-awareness can prevent unnecessary losses.

Trading psychology Indonesia: Avoiding Common Psychological Traps

Source: Instaforex

Several mental traps can sabotage a trader’s progress. FOMO (Fear of Missing Out) leads to impulsive entries, often in overbought conditions. Revenge trading—when you try to recover losses emotionally—usually ends in more damage. Then there’s overtrading: placing too many trades without clear reasoning, often as a result of boredom or overconfidence. These traps aren’t about knowledge gaps; they’re psychological patterns. Recognizing them is the first step to change. Many Indonesian traders find it helpful to take short breaks during drawdowns to reset emotionally.

Cognitive Biases: The Invisible Enemy

Source: ThoughtCo.

Cognitive biases, such as the gambler’s fallacy or herd mentality, distort how traders perceive the market. You might assume a price will bounce just because it has dropped for several days—that’s gambler’s fallacy. Or you might follow a trend just because everyone on social media is buying—that’s herd mentality. These biases are dangerous because they feel logical in the moment. Part of mastering trading psychology Indonesia is learning to identify these traps before acting on them. Journaling your decisions and reasons can help spot recurring biases in your own trading.

Developing Emotional Resilience Over Time

Source: Marktossell

Psychological strength in trading isn’t built overnight. Like muscles, it develops with training, reflection, and consistency. One useful tool is a trading journal—not just for numbers, but for emotions. After each trade, ask yourself: Why did I enter? How did I feel before and after? What would I do differently? Over time, this habit creates mental resilience. Indonesian traders who review their emotional patterns are more likely to grow into long-term, sustainable professionals rather than high-risk speculators.

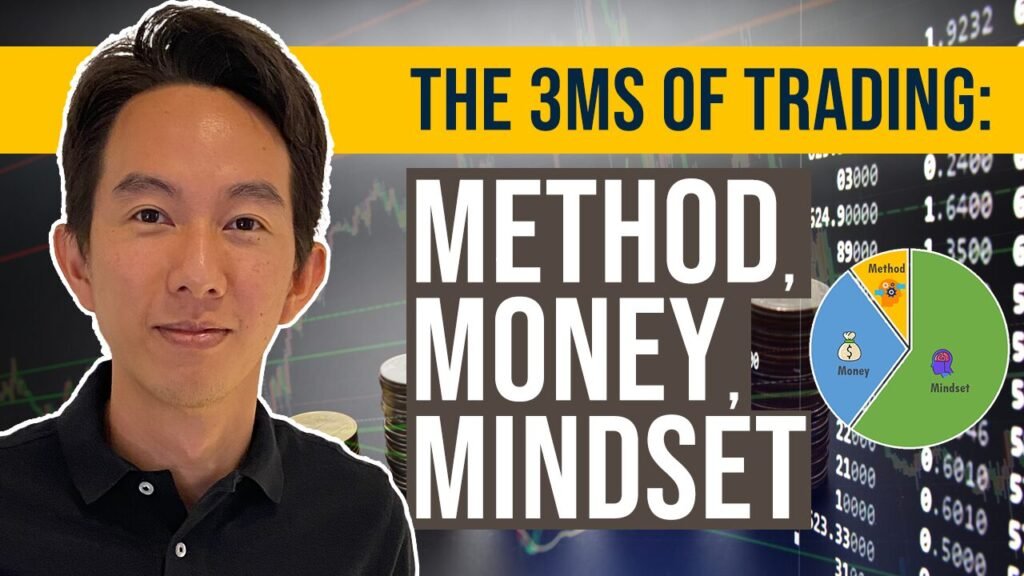

The Power of the 3M Framework: Mind, Method, Money

Source: synapsetrading

A helpful structure for building trading discipline is the 3M framework—Mind (psychology), Method (strategy), and Money (risk management). Many new traders obsess over methods and indicators, but ignore the “Mind” pillar. Without strong psychology, even the best strategy will fail. Similarly, risk management isn’t just a numbers game—it’s about respecting limits and not letting ego dictate trade size. Successful traders in Indonesia who focus on all three pillars develop a stronger, more balanced approach to the market.

Practical Tips to Improve Your Trading Psychology

Source: equiti

Improving your trading mindset starts with small, consistent practices. Begin by setting realistic profit targets and accepting that not every trade will be a winner. Use stop-loss and take-profit levels religiously—not as suggestions, but as rules. After big wins or losses, step away from the screen for a few hours to cool down. Emotional extremes often lead to impulsive behavior. Lastly, talk to fellow traders—not for tips, but to share experiences. Building a support system can ease the mental stress that often goes unspoken in trading.

Conclusion: Why Trading Psychology Indonesia Can’t Be Ignored

In the long run, trading is less about predictions and more about preparation. The market will test your mindset again and again—through losses, false signals, and missed opportunities. Developing strong trading psychology Indonesia helps you respond with clarity, rather than react with emotion. It takes time, practice, and honest reflection. But for traders who invest in their mental game as much as their strategies, the reward is greater consistency and a stronger foundation for long-term success.