Crypto vs Gold: A Step-by-Step Guide to Hedging Inflation in Vietnam

February 1, 2025

Crypto vs Gold: A Practical Guide for Hedging Inflation in Vietnam’s Economic Uncertainty

For many Vietnamese people, especially during periods of rising inflation or economic instability, protecting savings is no longer just a long-term goal — it’s an urgent daily concern. In this environment, a common question arises: crypto vs gold — which is the safer hedge against inflation and financial crises in Vietnam?

This guide offers a practical, step-by-step look at how Vietnamese investors typically use gold and crypto to protect their wealth when markets turn uncertain.

Step 1: Why Inflation Hedging Matters in Vietnam

Inflation in Vietnam affects more than just prices at the market. It can slowly erode the value of savings and limit the future purchasing power of families. When the Vietnamese dong weakens or local financial markets fluctuate, many people look for assets that can hold their value. Gold and crypto have become two of the most discussed options.

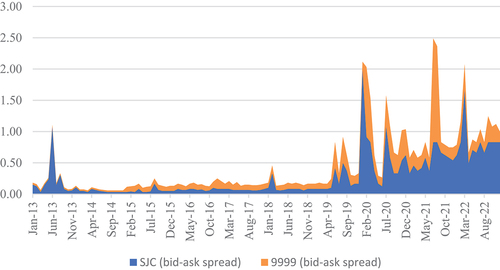

Source by: Taylor & Francis Online

Step 2: How Gold Works as a Traditional Inflation Hedge in Vietnam

Gold is not just a financial asset in Vietnam — it is part of everyday life. For generations, Vietnamese families have bought gold to preserve value. Whether it’s in the form of jewelry, gold bars, or even small gold rings, it has been used as a safe place to store wealth.

When inflation rises or when people fear currency devaluation, local gold shops often see increased demand. This was visible in previous financial slowdowns, when queues formed outside gold stores in cities like Hanoi and Ho Chi Minh City.

Gold’s reliability is one of its main attractions. Its price tends to rise when the Vietnamese dong loses strength, making it a practical shield against inflation. Additionally, gold is easy to buy and sell in Vietnam, making it a convenient option when quick financial decisions are needed.

Step 3: How Crypto Became a New Option for Vietnamese Investors

In recent years, cryptocurrencies have gained popularity in Vietnam, particularly among younger generations and digital-savvy investors. Unlike gold, crypto offers something faster and more borderless. It can be bought, sold, and transferred at any time, across national boundaries, without depending on banks.

Many Vietnamese investors began exploring crypto as a possible hedge during times of financial uncertainty, especially when concerned about currency risks. Crypto’s ability to move value quickly appeals to those who want flexible alternatives.

However, crypto is far less stable than gold. While its value can increase rapidly, it can also drop sharply within hours. This high level of price volatility makes crypto riskier for those who are primarily looking to protect their savings during crises.

Step 4: Comparing the Real Crypto vs Gold Risks in Vietnam’s Context

While gold’s reputation for safety is well-established in Vietnam, crypto remains more of a speculative tool. Gold is legal, regulated, and widely accepted in local transactions. Crypto, however, sits in a legal grey area. It is not officially banned, but the Vietnamese government does not currently allow it as a legal payment method, and its future regulatory path remains uncertain.

For investors in Vietnam, this means that gold is usually the safer option when the goal is wealth protection, especially during times of political or financial stress. Crypto can offer flexibility, but also exposes investors to sharp price changes and possible legal shifts that may restrict trading.

Step 5: Starting a Hedge Strategy in Vietnam

For those starting to build a hedge against inflation, many Vietnamese investors still prefer to begin with gold. Purchasing from well-known gold shops ensures fair pricing and offers immediate physical possession, which provides peace of mind for many families.

Entering the crypto space requires more preparation. Investors need to create accounts on digital exchanges, secure digital wallets, and closely follow price movements. Unlike gold, which many can comfortably hold for years, crypto often demands more frequent monitoring.

Step 6: Balancing Gold vs Crypto in a Personal Strategy

In Vietnam, it is becoming more common to combine both gold and crypto as part of a broader personal finance strategy. Some investors view gold as the steady base — a cultural and financial anchor — while crypto is treated as a flexible, fast-moving asset that might provide additional growth opportunities.

The right balance depends on individual risk comfort. For those more cautious, gold typically takes a larger share. For those willing to accept higher short-term risks, crypto may play a larger role.

Conclusion: Crypto vs Gold — Practical Choices for Vietnamese Investors

When considering crypto vs gold as an inflation hedge in Vietnam, both assets offer different kinds of protection. Gold’s long-standing role as a safe haven remains strong, especially during financial crises and periods of high inflation. Crypto brings a modern, faster option but carries greater risks and legal uncertainties in Vietnam.

Ultimately, Vietnamese investors navigating uncertain times may find that blending both assets — in amounts that match their personal risk levels — is a practical way to build resilience. In Vietnam’s changing economy, understanding how both gold and crypto behave locally can help protect savings in a more thoughtful, step-by-step way.